Better customer lifecycle management

Tokenization is powering today’s secure digital payments

Most businesses with an online presence depend on tokenization to help protect their customers’ sensitive card information during transactions. But managing tokens in your ecosystem can be complex and they require maintenance (when a customer changes their bank or a card is lost, stolen, or expires).

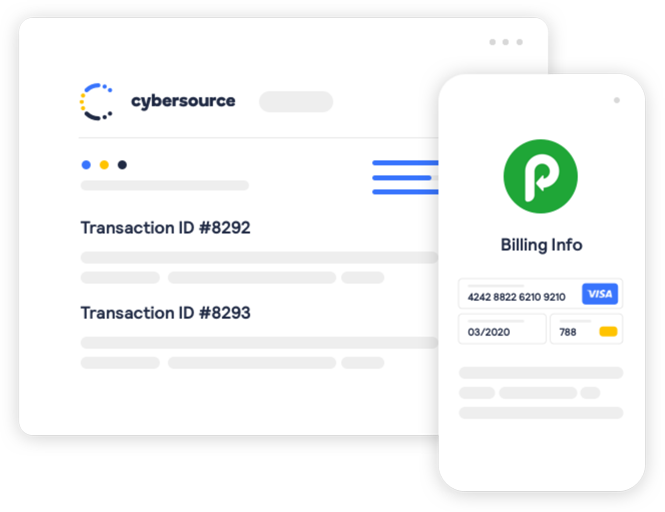

Create a more complete view of your customers

Cybersource’s Token Management Service dramatically simplifies this complexity by connecting your payments, customer data, and other network tokens into a unified proprietary super token that provides you with a 360-degree view of your customers’ buying behaviors across all channels and payment types.

The super token: A Cybersource innovation

Our Token Management Service is the only service of its kind that links tokens from different networks, issuers, and channels to help you simplify complex payment environments. The super token also includes alternative payments such as eCheck, ACH, and other debit products. And Token Management Service’s brand-agnostic platform processes network tokens for both Visa and Mastercard.

Build a secure and seamless customer experience

Token Management Service makes customer lifecycle management easy. Credentials are updated and refreshed across channels, which can maximize revenue from returning customers.

Increase your conversion rates

With the super token’s improved insights, you can recognize legitimate repeat customers more effectively, enhancing approval rates and increasing conversions.

+3%

Authorization rates

+3% token auth lift.1 Global average for CNP transactions as compared to PAN.

-28%

Fraud

Network tokenization can reduce fraud by an average of 28% without creating additional payment friction for your customers.2

Protect sensitive customer data

Your customers’ payment data never touches your internal systems. Top-tier Visa security keeps data encrypted and secured, so it’s protected from breaches and theft through every step of the payment process.

Deepen your customer relationships

By bringing together tokens from different card brands, banks, payment types, and channels, our super token provides a 360-degree view of your customers’ buying behaviors. With this insight, you can build long-term relationships and make customer loyalty and rewards opportunities part of every online, mobile, and in-store transaction.

Reduce PCI DSS scope and costs

Token Management Service meets the strictest regulatory standards for encryption and data security.

Easy and fast integration

Token Management Service can be integrated with our other powerful tools, including Decision Manager, Payer Authentication, Account Takeover Protection, Recurring Billing, and Global Gateway.

There are more than 7+ billion Cybersource tokens in use throughout the world securing sensitive payment data3

More about the benefits of tokenization

A guide to network tokenization

From how tokenization works to Cybersource’s innovative super token, this guide covers everything you need to know about tokenization and its benefits.

Why the future of eCommerce is tokenization

eCommerce tokenization has changed digital payments, but its potential is only just being realized.

Tokenization in action

Integrate Token Management Service with other Cybersource solutions to create frictionless payments

Let's talk tokens

Our Token Management Service delivers all the benefits of payment tokenization in a single solution, either as a standalone or fully integrated with your payment ecosystem.

Cybersource’s token expertise and brand-agnostic coverage spans 160+ countries and territories. We can help you maximize the benefits of tokenization, regardless of where you are on your journey.

1 VisaNet, Jan-Mar 2022. Visa credit and debit global card-not-present transactions for tokenized vs. non-tokenized credentials. Auth rate defined as approved count of unique transaction authorizations divided by total unique authorization attempts, based on first auth attempt only.

2 VisaNet, Jan-Mar 2022. Visa credit and debit global card-not-present transactions for tokenized vs. non-tokenized credentials. Auth rate defined as approved count of unique transaction authorizations divided by total unique authorization attempts, based on first auth attempt only. (PAN & Token) with digital wallet TRs April-June 2018, Issuer region: US.

3 Cybersource Token Management Service and Secure Storage token metrics on Sept. 13, 2022 as calculated by Cybersource Database Engineering team.