Stay ahead of card-testing attacks

Account-related fraud occurs when fraudsters use stolen consumer credentials (typically username/email and corresponding passwords) to take control of an existing account. These same individuals may also use stolen personal information to establish new fake accounts. The fraudsters can then use these accounts to carry out unauthorised activities, including loyalty fraud, card testing and bad transactions.

Block fraud at the account level to avoid bad transactions

Compromised accounts can ultimately produce more fraudulent transactions, along with the associated chargebacks, loss of inventory and dispute resolution costs.

By identifying and reducing account fraud up front, you could remove the potential for bad transactions and related costs downstream.

Safeguard your loyalty programmes

Fraudsters are also on the lookout for weak points in loyalty programmes. In this scenario, cybercriminals take over good customers' accounts to steal reward points and resell or redeem them.

Account Takeover Protection monitors high-risk behaviour at account access, purchase and redemption of points, so you can protect your incentive programmes and drive customer loyalty.

More fraudsters are using botnets to superpower their card-testing schemes. In these attacks, fraudsters run thousands of low-value transactions on a merchant's site to "test" the validity of card details. By the time the merchants notice, they often face a staggering number of authorisation fees, and the chargebacks may jeopardise their standing with major processors.

Promote customer trust and recurring revenue

Account-related fraud can have far-reaching consequences for victims, negatively impacting brand loyalty and recurring revenue. Account Takeover Protection can keep both your users and your reputation safe while ensuring your good customers enjoy a seamless experience on your site.

Protect customer accounts from credential stuffing

Cybercriminals use sophisticated methods to access accounts. The now prevalent use of botnets means fraudsters can conduct large-scale automated login attempts to validate and use stolen credentials. This, credential stuffing, puts businesses at risk of account-related fraud. Account Takeover Protection screens for credential stuffing to help keep your business safe.

27%

of merchants globally are impacted by loyalty fraud1

50%

of merchants indicated that improving customer experience was the most important fraud management priority in 2021, up from 27% in 20191

23%

of merchants globally are impacted by account takeover1

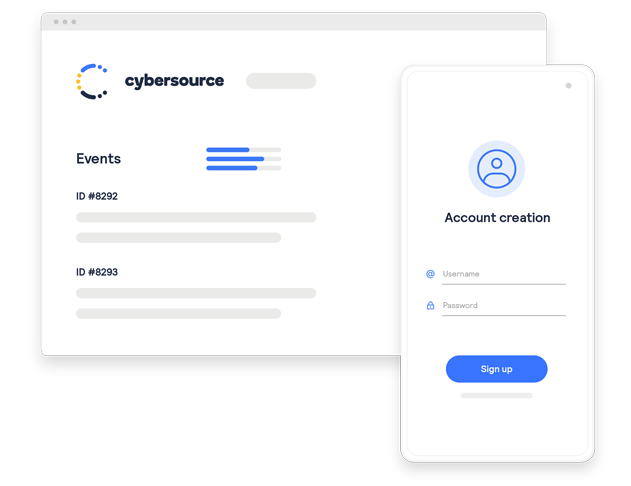

See how Account Takeover Protection works

Flexible interface and rules engine

A flexible rules engine identifies suspicious activity based on the requestor’s behaviour, email, device and other attributes. You decide whether to accept, reject or challenge account-related requests.

Performance reports

These reports help you to understand what rules are being triggered, and with what resulting outcome, which in turn can assist with rule optimisation and better service performance.

Account Takeover Protection operates on the same platform as our payment risk review service Decision Manager, providing the critical ability to share learning from the payment side to the account review side and vice versa. By using Account Takeover Protection in combination with Decision Manager, you can access information about pre-purchase account activity during review. Since Account Takeover Protection leverages the same integration, customers using Decision Manager can easily add the Account Takeover Protection service. Enable Account Takeover Protection and start safeguarding your customer accounts today.

Understanding account takeover and its impacts

Learn what account takeovers are and how they can impact a business and its customers.

How real is the loyalty fraud threat?

Fraudsters who successfully take over accounts will take anything that has immediate or resale value—and that includes loyalty points and rewards.

Identifying and preventing loyalty takeover fraud

Learn about the steps your business can take to guard against account takeover and loyalty fraud, and preserve customer trust.