Advance ML-driven risk score

Remove the guesswork with Cybersource’s machine learning

Take the guesswork out of payment fraud with our machine-learning fraud management solutions, beat fraudsters at their own game.

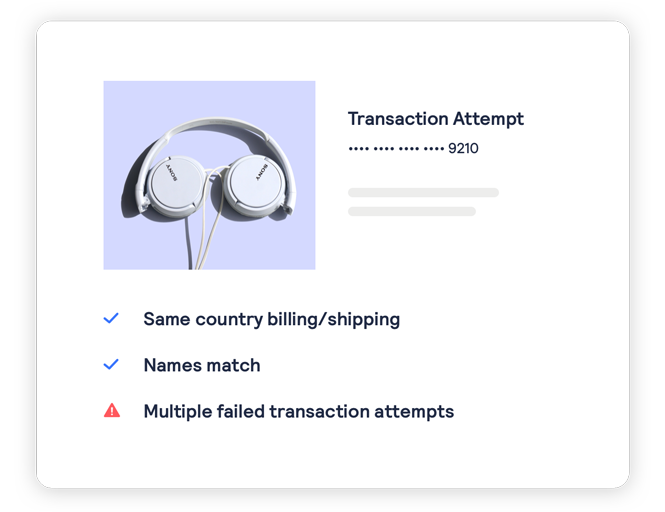

Simplify fraud detection by using an automated risk scoring for each transaction

But how can you determine whether the solution you’re using is up to the task? And what really drives risk score accuracy within a machine learning model?

Leverage historical customer identity information across different industries and artificial intelligence to produce a highly accurate fraud score in less than a second.

Continuously adapting models

Continuously analyses and processes new data, then updates risk models to reflect the latest trends and quickly adapt to market conditions.

Automated risk strategies

Constantly optimises and strengthens our risk models with high-quality data and a rapid processing speed to automate fraud management from day one.

Robust data intelligence

Access to 141 billion VisaNet transactions and elements from TC40 data provides a global view of emerging fraud trends and automatically identifies good customers.1

Rely on Cybersource’s powerful machine learning fraud detection

Rather than rely on just one statistical algorithm, Cybersource combines several different methods to leverage each risk model’s unique strengths and applies the best risk model for each transaction.

Powered by Visa’s AI platform and enriched through access to VisaNet, one of the world’s largest single sources of transaction data, Cybersource’s machine learning generates highly accurate risk scores using in real-time to automate fraud detection and identify good customers.

Focus on your business, we will manage the fraud

For eCommerce businesses, staying ahead of payment fraud is a difficult and constantly evolving battle. Fraudsters grow smarter, bolder, and more sophisticated every year—developing new tactics and techniques that quickly make static anti-fraud measures less effective. Learn more by downloading our white paper.

Empowering you to accept more good orders from new customers

We leverage historical customer identity information across different merchants and automate fraud detection by analysing one of the largest networks of transaction data as a foundational part of our machine learning.

We understand identities more effectively and track how they are used over time—empowering you to accept more good orders from new customers, while also delivering agile, accurate risk scoring targeted to industries, regions and payment methods.

Learn how Cybersource’s ML-powered solutions can help you:

- Accept more good transactions and streamline online purchases from the start

- Lower fraud management costs through reduced false positives and manual reviews

- Enable you to stay focused on refining your core business strategies to further optimise revenue

Learn more about our ML-innovations that help automate risk management:

- Decision Manager’s:

- Identity Behavior Analysis

- Rules Suggestion Engine

- Unified Consortium Model

1 VisaNet transaction volume based on 2020 fiscal year. Domestically routed transactions may not hit VisaNet.