Seamless checkout experience

What is Click to Pay?

Click to Pay is a network supported digital payment option provided by Visa, Mastercard, American Express, and Discover. It simplifies the online checkout process, allowing consumers easy access to their stored payment methods. Click to Pay is a fast, secure, and convenient way to check out without entering your credit number for in-app or online purchases.

Why Click to Pay?

Click to Pay provides simple and smooth checkout experiences that allow customers to bypass entering payment details.

Secure and safe

Click to Pay is secure and encrypts all payment information.

Powered by major payment networks

Click to Pay checkout is supported by the major payment networks. Customers can use the same benefits and rewards provided by their card issuer.

Benefits for you

- Faster checkouts and fewer abandoned carts

- Higher authorisation rates and lower fraud risk

- Store customer data securely thanks to tokenization

- Easily integrated into existing checkout flows

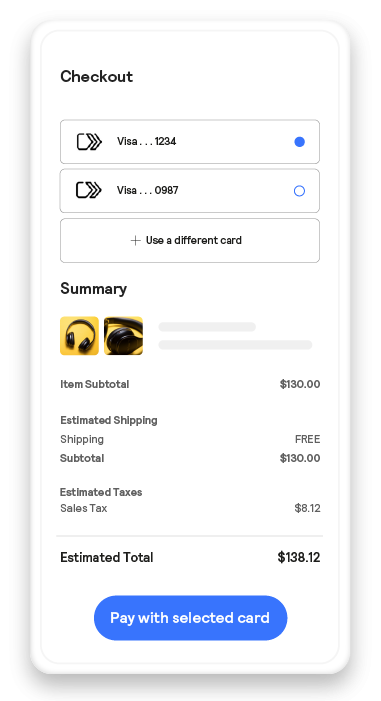

- Display stored cards as easy-to-read buttons

- Frees up time to focus on customer signup

- Works seamlessly with your existing 3DS solution

- All possible with a single integration

Benefits for your customers

- One-click checkout, even as a guest

- Works across all devices and browsers

- No need to enter account numbers or passwords

- Peace of mind that card data is secure

- Keeps cards on file and payment card details up to date

- Easy to sign up for Click to Pay from banking apps or your site

How does Click to Pay work?

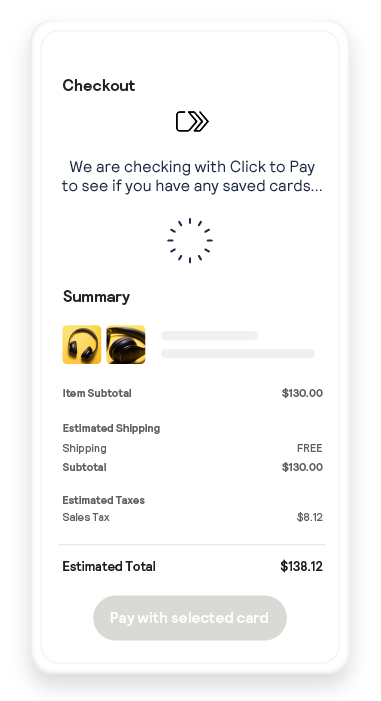

One of the best things about Click to Pay is how easy it is for customers to register. They can quickly enable Click to Pay for their cards on their banking apps or the first time they visit your website. From then on, every payment they make on your site is simple.

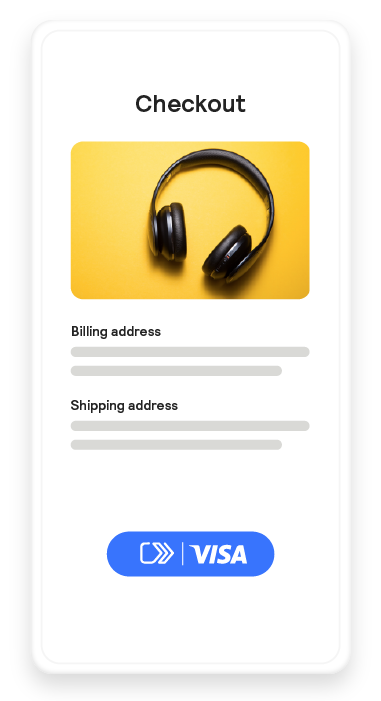

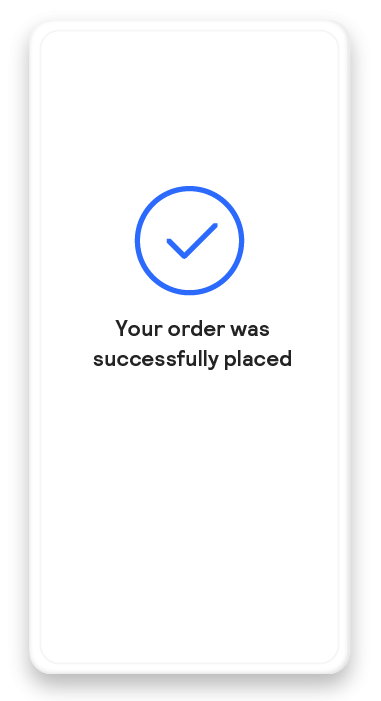

1. At online checkout, the customer chooses Click to Pay as the preferred payment method.

2. The customer adds the card that they want to pay with.

3. The customer verifies the information and selects a card to pay.

4. The merchant and customer are notified of the successful transaction.

How can I enable Click to Pay?

We can help you quickly and easily add Click to Pay to your checkout experience with multiple solutions to fit your needs.

Unified Checkout Integration with Click to Pay

A single interface for Cybersource gateway clients to accept payment methods like Click to Pay.

Click to Pay Drop-in UI Integration

A quick, easy way to add Click to Pay to your checkout experience, regardless of your gateway.

More about Click to Pay

| COUNTRIES | |

|---|---|

| Consumer | Learn more (not available in Chile and Guatemala) |

| Merchant | Learn more (not available in Chile and Guatemala) |

| TRANSACTIONS |

|---|

| Network token-based transactions |

| COMPATIBILITY |

|---|

| All browsers available |

| All devices available |

| FEATURES | |

|---|---|

| Recurring payments | |

| One-click payments | |

| Refunds | |

| Partial refunds | |

| Multiple partial refunds | |

| Payment assurance | |

| Chargeback risk |

Find out more

Invoicing

Invoicing provides a quick way to invoice and receive payments from any customer with an email address, without having to manage multiple systems.

Recurring payments

Enable recurring payments to protect and increase your revenue while saving your team time.

Integration methods

Make your digital payment experience frictionless with our range of integration methods.

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Cybersource.