The pandemic-driven shift towards digital in customer buying behavior is real, and it's happening globally.

There's no doubt that customer buying behavior has changed in the context of pandemic-related restrictions and health concerns. But how similar are the trends across regions? The 2020 Global Digital Shopping Index reports, a collaboration with PYMNTS and Cybersource, show that digital-first experiences and cross-channel shopping are more popular with consumers globally than ever before.

Consumers appreciate digital-first shopping experiences

In the face of pandemic-related restrictions—and concerned about their own health and safety—consumers have gone online to shop. Although brick-and-mortar stores are still the most popular shopping channel in all regions surveyed—for example, 67 percent of Australian consumers prefer to shop in store —online-native and cross-channel shopping have grown at a remarkable rate.

The Global Digital Shopping Index reports, a collaboration between PYMNTS and Cybersource, are based on both merchant and consumer surveys in four countries around the globe: U.S., Australia, U.K. and Brazil. Each report surveyed approximately 2,000 consumers and approximately 500 merchants—full methodology here.

Online-native shopping: more than a passing phase

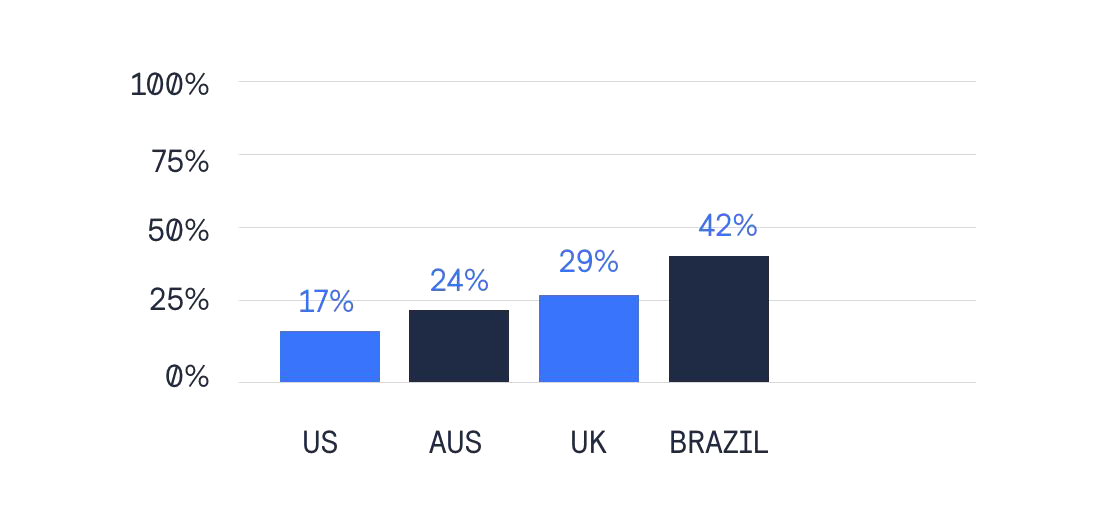

The Internet no longer plays a supporting role in consumers' shopping habits. Since the start of the pandemic, there's been significant growth in the share of online-native shoppers—consumers who start their purchases in digital channels and complete them there if they can, with their goods delivered to their door.

Online native shopping growth

Source: The Global Digital Shopping Index reports, Cybersource and PYMNTS, 2020

All the signs suggest this isn't just a passing phase: rather, it's a fundamental change in how consumers prefer to shop.

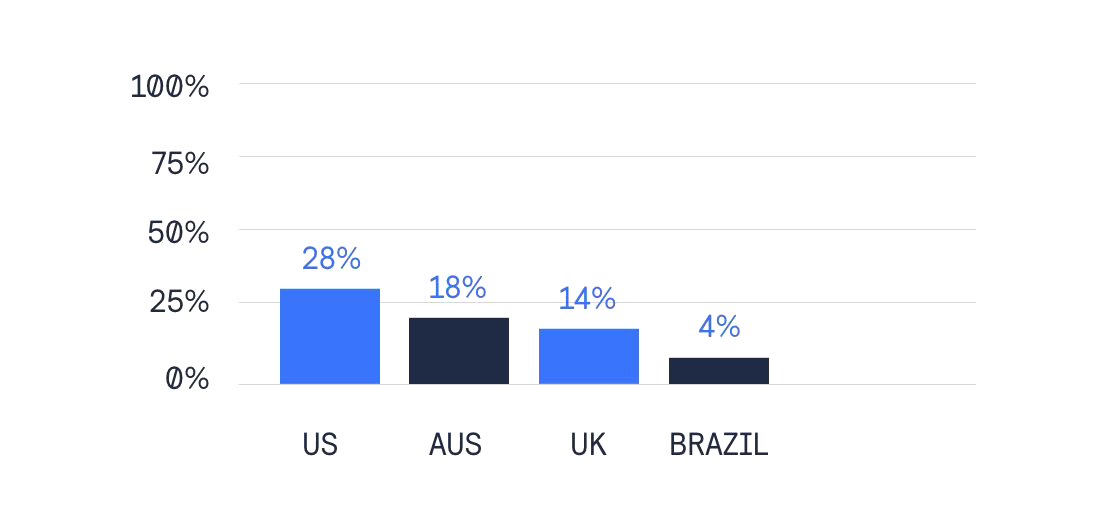

Cross-channel shopping is also on the rise

Cross-channel shopping—where customers order and pay online, then collect goods curbside or in the store—has also become more popular in all regions, with the U.S. showing the biggest growth.

Growth in cross-channel shopping

Source: The Global Digital Shopping Index reports, Cybersource and PYMNTS, 2020

In the U.S., 16 percent of online shoppers choose curbside pickup vs. 14 percent who opt for in-store collection. In Australia and the U.K., it's the other way around: Cross-channel shoppers prefer to pick up in-store (often called 'click and collect') rather than curbside . This may reflect the fact that curbside pickup is still a developing option in these countries.

Creating digital-first customer experiences

Since the pandemic began, the strongest shifts in customer shopping behavior have been towards online-native and cross-channel shopping experiences. The exception is Brazil, which saw a larger increase in mobile-native shopping . All the indicators are that a growing share of consumers favor the safety, convenience, and efficiency of online shopping channels and the digital features they offer.

To take advantage of these trends, retailers should ensure they're equipped with flexible, creative commerce solutions that deliver the satisfying digital-first experiences consumers increasingly expect.

Look out for the next blog in our series which discusses two further trends: the decline in in-store shopping as customers become more satisfied with the online customer experience.

Learn more about the digital-first shift in customer buying behavior and download the Global Digital Shopping Index reports, a collaboration with PYMNTS and Cybersource.

1 The 2020 Global Digital Shopping Index, Australia Edition,” Cybersource and PYMNTS, 2020.

2 The 2020 Global Digital Shopping Index, U.S. Edition,” Cybersource and PYMNTS, 2020, p. 10-11.

3 The 2020 Global Digital Shopping Index, Australia Edition,” Cybersource and PYMNTS, 2020, p. 5.

4 The 2020 Global Digital Shopping Index, U.K. Edition,” Cybersource and PYMNTS, 2020, p. 4.

5 The 2020 Global Digital Shopping Index, Brazil Edition,” Cybersource and PYMNTS, 2020, p. 4.