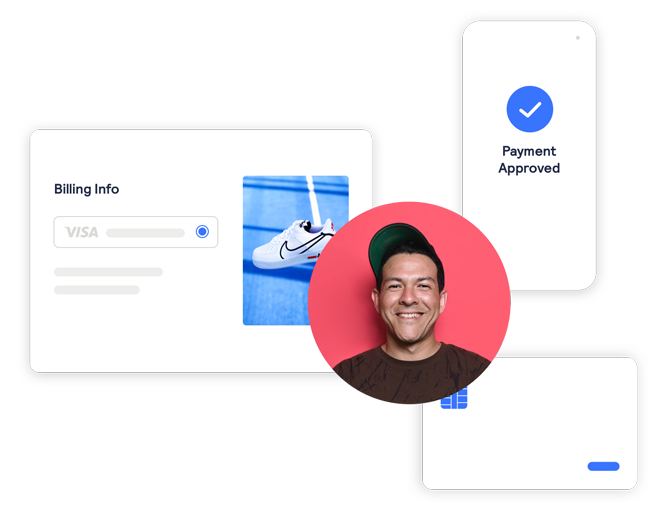

Improve issuer authorization rates

Confronting the card-not-present authorization gap

The loss of a good customer is extremely expensive. In a competitive environment, consumers whose transactions are declined are likely just one click away from switching to a competing business—not just for that transaction, but also for any future orders.

Our revenue capture initiative can help your business increase issuer authorization rates, improve customer satisfaction, and recover lost revenue. Cybersource and Visa have the experience, scale, and connections to pioneer a change of this scope.

In this white paper

Cybersource Vice President of Risk Solutions, Andrew Naumann, explains how Cybersource is collaborating with card issuers, acquirers, and businesses to increase eCommerce authorization rates.

The path to minimizing loss and maximizing revenue

Manage fraud effectively

Businesses have faced a difficult dilemma: There were no easy solutions for how to manage fraud effectively. Fraud costs, customer satisfaction and operational costs were inextricably linked. Pushing any one of these levers impacted the other two.

Use a nuanced approach

While eCommerce revenue is increasing, transaction approval rates weren’t increasing. Capitalizing on revenue growth requires a nuanced approach to eCommerce transactions that helps card issuers accept more payment card authorization requests with greater confidence.

Maximize revenue

As an industry leader in payments and fraud management, we teamed up with businesses, issuers and acquirers to guide you in how to maximize revenue as part of your fraud management strategy.

Next step

The next step in fraud management isn’t really about fraud management at all. It’s about recapturing lost revenue by optimizing authorization conversions. Learn how fraud management strategies have changed over time and more about Cybersource’s five revenue capture initiatives in this white paper.

Five initiatives to capture more revenue

- Lowering chargeback rates

- Authorization rate reporting

- Pre-screening transactions prior to authorization

- Optimizing tool configurations

- Preserving the customer experience with automated authentication