Streamlined operations

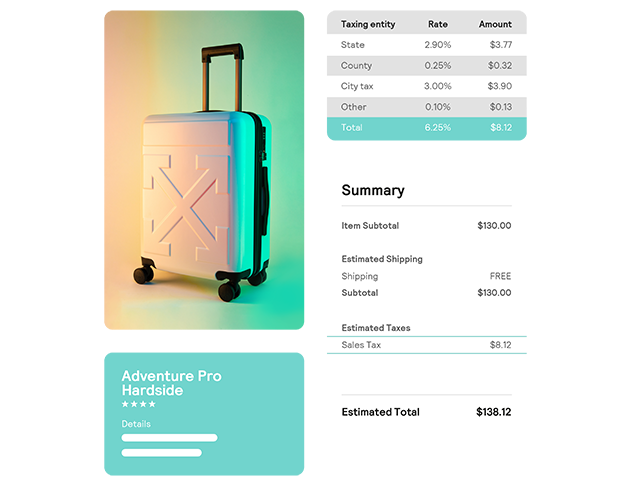

Global Tax Calculation

With automated tax calculation, your customers can quickly checkout, with the correct tax applied for their city, county, state and country.

A single connection to Cybersource’s API allows you to integrate your tax calculation and payment management services.

Seamless checkouts

Automated technology assesses tax in real time, providing a frictionless path to purchase.

Improved accuracy

Precise tax assessments reduce compliance risks, such as audits and subsequent fines.

Comprehensive coverage

Sales and local tax calculation across the US and Value Added Tax (VAT) in many countries.

What you need to know about sales tax nexus laws

If you’re selling across state lines, read this article to understand what sales tax nexus laws are and how you avoid common pitfalls.

Additional benefits

- Apply the right rate based on order details and tax rules

- Use geolocation–rather than zip code-based tax tables, to locate the precise jurisdiction

- Calculate tax without time-consuming tax research or specialized software

- Enter global markets easily, with less compliance risk

- Calculate tax in 12,000 jurisdictions in the US and VAT In 160 countries

- Avoid cart abandonment by providing a clear and correct assessment of fees

- Track and download reports for taxable and exempt sales in Cybersource’s Enterprise Business Center

Integrated service API calls can help

- Reduce errors and latency associated with making multiple calls

- Ensure your payment process has all the right steps and checks