Simplify network tokenization adoption

Meeting consumer expectations

Consumers expect personalized, frictionless payment experiences and, as digital commerce grows, meeting these needs now and in the future should be a top priority. A robust tokenization solution can help you keep up with changing customer expectations—and get deeper insights that can drive innovative payment experiences.

Tokenization is powering today’s secure digital payments

Most businesses with an online presence depend on tokenization to help protect their customers’ sensitive card information during transactions. But managing payment tokens and customer data in your ecosystem can be complex.

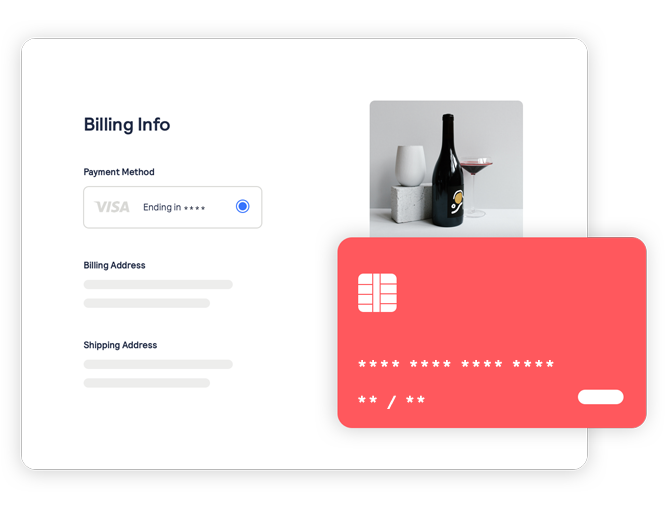

Secure customer data management

Token Management Service can dramatically simplify this complexity by securely managing payment tokens and multiple points of customer data across payment types and channels, providing you with a 360-degree view of your customers’ buying behaviors. This view into customer buying behavior can help you enable innovative seamless shopping experiences your customers want now and will expect in the future.

Tap into the power of Token Management Service

A major step forward in tokenization has been the arrival of network tokens. Token Management Service helps streamline network token adoption, access, and management through a single solution.

Credential management

Token Management Service makes customer lifecycle management easy. Credentials are updated and refreshed across channels, which can maximize revenue from returning customers.

Increase authorization rates

+4.6% token auth lift.1 Global average for CNP transactions as compared to PAN.

Reduce fraud

Network tokenization can reduce fraud by an average of 28% without creating additional payment friction for your customers.2

Protect customer payment data

Your customers’ payment data never touches your internal systems. Visa security keeps data encrypted and secured, so it’s protected against breaches and theft through every step of the payment process.

Deepen your customer relationships

By securely managing customer data and providing a 360-degree view of your customers’ buying behaviors, you can build long-term relationships and make customer loyalty and rewards opportunities part of every online, mobile, and in-store transaction.

Simplify mandate compliance

Simplify regional regulatory and brand compliance like payment card industry data security standard (PCI DSS), merchant-initiated transactions (MIT), and

cardholder initiated transactions (CIT) without the need of a dedicated resource, saving you time and money.

Easy and fast integration

Token Management Service can be integrated with our other powerful tools, including Global Gateway and Visa Acceptance Platform.

More about tokenization

Simplify network tokenization

Network tokenization is an emerging tokenization technology. See how Token Management Service simplifies network tokenization management and access.

Token Management Service product overview

Token Management Service can help you harness the power of tokenization and securely manage customer data to drive innovation and growth.

Let's talk tokens

Token Management Service delivers all the benefits of payment tokenization in a single solution, either as a standalone or fully integrated with your payment ecosystem.

We can help you maximize the benefits of tokenization, regardless of where you are on your journey.

1 VisaNet, Oct-Dec 2022. Visa credit and debit global card-not-present transactions for tokenized vs non-tokenized credentials. Auth rate is defined as approved authorizations divided by total authorization attempts based upon first attempt of a unique transaction.

2 VisaNet, Jan-Mar 2022. Visa credit and debit global card-not-present transactions for tokenized vs. non-tokenized credentials. Auth rate defined as approved count of unique transaction authorizations divided by total unique authorization attempts, based on first auth attempt only. (PAN & Token) with digital wallet TRs April-June 2018, Issuer region: U.S.