U.S. shopping index

Creating a digital-first customer experience

Learn more about digital shifts in consumer shopping, becoming a digital-first business, and flexible commerce solutions to make way for better experiences.

What does “digital first” mean?

“Digital first.” The term has been thrown around a lot these days, but what does it actually mean and how does it relate to your business? “Digital first” refers to the ever-changing need to be, think, and create commerce experiences with a digital-first mindset. This approach recognises that the digital landscape and buyers’ expectations are changing faster than ever, and that businesses must innovate to keep up with them.

Why digital first?

Effective digital strategies are especially important to merchants right now given the major changes in shopping behaviour due to the COVID-19 pandemic. According to the 2020 Global Digital Shopping Index, consumers view the friction associated with in-store shopping not just as an inconvenience, but as a real safety concern. Retailers in this environment must do more to ensure that consumers’ shopping journeys—whether online, in-store, or omnichannel—feel seamless and efficient, from browsing to order fulfilment.

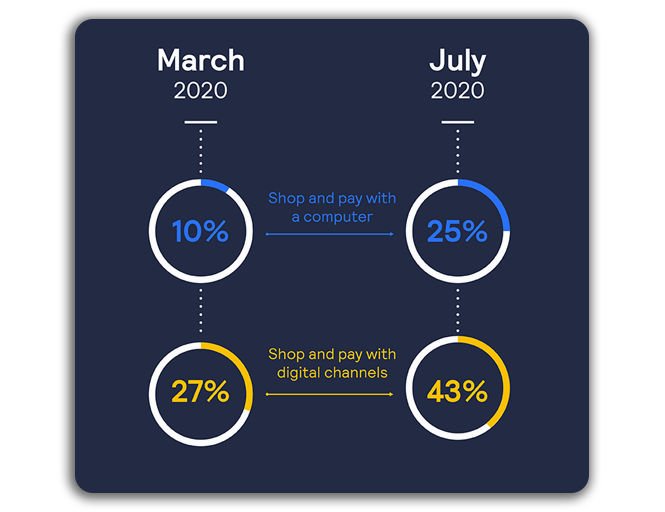

March 2020 vs July 2020 shopping behaviours

Payments have taken on singular importance amid greatly diminished foot traffic and heightened anxiety. Robust and integrated systems may not only ensure that customers have smoother shopping journeys, but they may be the key to keep them coming back.1

Read more about why a digital transformation strategy is key right now.

We’ve seen a dramatic evolution in how consumers shop in the past year. They’ve turned to online channels since the start of the pandemic, and they intend to maintain many of the digital shopping habits they have adopted as the economy recovers. The 2020 Global Digital Shopping Index, a collaboration between PYMNTS and Cybersource, reveals top consumer shopping trends in the U.S., U.K., Australia, and Brazil.

Based on surveys of more than 2,170 U.S. consumers and 500 U.S. merchants, this edition highlights how consumers have less patience for friction in shopping experiences.

Australia shopping index

Digital shopping journeys have increased in Australia by 25 percent since the pandemic.

U.K. shopping index

Forty-six percent of U.K. consumers now prefer to start their shopping trips digitally.

Brazil shopping index

Consumers in Brazil are highly mobile-oriented, and this is reflected in their shopping behaviours.

UK Global Shopping Index highlights

- UK consumers stand out for their interest in digital-first features, such as the adoption of cardless payments—and are gravitating to online shopping

- Retailers overestimate the degree to which they are meeting consumer demand for their preferred digital features

- To keep up, retailers need to resolve the experience disconnect across shopping channels, and prioritise the right digital features for investment

According to 451 Research analyst, Jordan McKee, the pandemic has permanently elevated the role and business value of payment technology. The need for agile, adaptable payment infrastructure and modern strategies has never been greater to accommodate the elevated role of digital commerce in consumers’ daily lives.2

The right payment partner will prove their value by driving a variety of favourable business outcomes that optimise costs, revenue, processes, and the overall customer experience. Most importantly, they will help to shoulder the complexity of interfacing with the global payments system to allow merchants to maintain a steadfast focus on their core business.

Cybersource is a fast track to a successful, single digital-first payment solution

It works because you finally get a solution that puts as much emphasis on the merchant experience as the consumer experience–so you can make way for better experiences inside and out. To accomplish this, you need:

More options

A modular platform gives you the building blocks needed to easily do business with anyone, through any channel, using any payment type, with any acquirer (while seamlessly working with your unique systems and processes all around the world).

More intel

A clearer view shows what’s coming next and a single, 360-degree view of your customers and their buying behaviour across every channel and region (plus global best practises and expert help with building better experiences).

A more complete approach

A payment platform helps you manage and monitor all your transactions through a single cloud connection (and backs it with a white-glove service, plus the strength and reliability of Visa-grade architecture).

1 Global Digital Shopping Index, U.S. Edition, p. 3.

2 Gaining a competitive advantage with a strategic approach to payments, 451 Research.