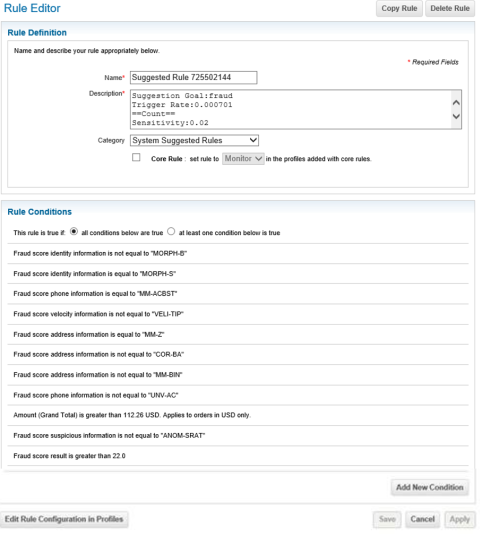

It is important for you to monitor your fraud strategy as fraudsters continually change their tactics. But how do you identify potential new fraud rules based on historical fraud patterns? Generate fraud rules based on historical data.

Cybersource Rules Suggestion Engine draws on your unique transaction data to automatically present recommended rules that can augment your existing fraud strategies. And each suggested rule is accompanied with appropriate metrics to help you measure its performance against the selected transaction data.

Machine learning creates new rules

We extended the capabilities of Cybersource Decision Manager beyond transaction scoring to bring machine learning into the realm of rules creation. Rules Suggestion Engine uses the outputs of Decision Manager’s advanced machine learning models as inputs into the rule creation process, suggesting new fraud rules to consider. Incorporating machine learning models helps increase the effectiveness of your fraud rules, enabling you to fine-tune your fraud strategies.

Stay one step ahead

With Rules Suggestion Engine, Cybersource is enhancing the analytical capabilities of Decision Manager beyond Decision Manager Replay. You can help meet the changing requirements to stay one-step ahead of fraudsters and accept more good customer orders.

Test the impact of suggested rules before implementing

Rules Suggestion Engine, in conjunction with Decision Manager Replay, enables you to test any proposed rule against historical data. With Decision Manager Replay, you can measure and understand the effectiveness of a particular fraud rule before implementing it in a live environment.

Why combine machine learning with rules

According to artificial intelligence (AI) pioneer Arthur Samuel, machine learning is a “field of study that gives computers the ability to learn without being explicitly programmed.”

What this means for fraud management, is that machine learning can detect subtle emerging fraud patterns that are impossible to see on a human level. Virtually all fraud management systems today use some form of machine learning, so what sets Cybersource Decision Manager apart?

The importance of data

Decision Manager has had machine learning from the beginning. Decision Manager is the only machine learning fraud solution that draws insights from Visa and Cybersource’s 68B+ annual transactions processed from around the globe. These transactions come from tens of thousands of merchants across a wide variety of industries and specialties. With this depth and breadth of data, it’s like having more high quality neurons in the machine learning “brain.” It just makes sense that better data leads to better fraud detection decisions.

Why rules are needed

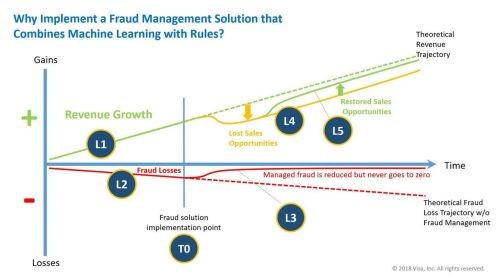

Another very important distinction with Decision Manager is the addition of powerful rules which adds a level of precision control for risk analysts. But why are rules important? Let’s explore a theoretical example of what can happen without rules.

Line L1 shows revenue growth before applying a fraud prevention tool. In the diagram, line L1 represents a theoretical revenue growth trajectory.

Line L2 shows fraudulent activity as a percentage of revenue. As revenues grow, if fraud losses are left unchecked, they too would continue to grow as a percentage of revenues as shown on line L2.

Line T0 represents the point in time when an organization implements a fraud management solution. Once a business realizes they have significant fraud losses, they will institute a fraud management system as shown at time T0.

Line L3 shows the reduced level of fraud by using a fraud management program. As the fraud management system starts learning from that business’ transaction data, the fraud loss level should gradually reduce as shown on the red line L3. It is virtually impossible to prevent all fraud, however through active fraud management, the fraud percentage can get very low.

Line L4 represents the reduced level of revenue due to a poor customer experience while managing fraud. False positives can lead to lost revenues as shown on the yellow line L4, not only due to the loss of the immediate sale, but even more by potentially losing a customer forever due of the rejected transaction. This has the impact of reducing revenue growth not only by interfering with business one transaction at a time, but tarnishing the experience for a legitimate buyer and compromising the lifetime value of customers.

Line L5 shows what active fraud management can do to restore revenues closer to the theoretical level. By combining rules with good manual review practices, many businesses may actually see an increase in revenue that comes very close to their theoretical revenue trajectory as seen in the green line L5. Decision Manager’s rules can be configured to activate at a specific time of day or date ranges, which can accommodate a variety of cyclic, seasonal and periodic sales promotions—helping maximize acceptance rates and revenues.

Rules provide customized control

By instituting rules, a risk analyst can inject human intelligence and set common sense parameters for their specific business. For instance, if the item being sold is a low priced digital good like a picture or song, the risk analyst might have a higher tolerance for the fraud risk score because there is no cost of goods. This is much different than an online retailer of big-ticket luxury items where the cost of goods is high—and there’s an open market for fraudsters to easily turn those goods into cash. Obviously in the latter case, the risk analyst will want to send questionable transactions to manual review prior to shipment.

The best of both worlds

Decision Manager employs machine learning that operates on insights from 68B+ global Visa and Cybersource processed transactions, enabling fast detection of emerging fraud patterns, while at the same time offering powerful rules that enable the injection of human ingenuity. Machine learning plus rules provides an excellent fraud management solution.