I recently gave a presentation at MRC 2019 in Las Vegas, where I discussed the state of eCommerce fraud management and Cybersource’s efforts to move businesses beyond simply controlling fraud—to actually grow their revenues.

Here’s a quick recap of that presentation.

Fraud management has come a long way in the past 10 years. At first, businesses were reactive, focusing almost exclusively on stopping fraud and minimizing direct monetary losses from fraudulent activity. That was Fraud 1.0.

Gradually, businesses also began to look for ways to enhance the efficiency of their fraud management operations and minimize false positives so they could reduce those costs as well. Let’s call that Fraud 2.0.

Fast-forward to the present: Many businesses have had success with Fraud 1.0 and 2.0. So today, they’re working to increase revenue—Fraud 3.0. This level of fraud management centers on delivering frictionless checkout experiences that help ensure consumers complete transactions successfully and ultimately grow merchant revenues.

Facing the challenge of card-not-present authorization

Unfortunately, providing a seamless checkout experience can be challenging, especially in card-not-present scenarios. When a customer is standing in a store, the cashier can check the physical card, request a second form of ID and verify the signature. But in card-not-present situations, businesses don’t have those same safeguards against fraud.

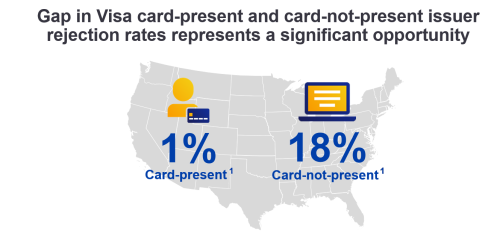

As a result, some issuing banks decline card-not-present transactions much more frequently than card-present transactions. In fact, according to 2018 VisaNet data, U.S. issuers rejected up to 18 percent of card-not-present transactions compared with just 1 percent of card-present transactions. 1

1Authorization rates in the United States in Q4 2018, VisaNet.

U.S. issuer rejection rates

- 1 percent of card-present transactions

- 18 percent of card-not-present transactions

With card-not-present sales expected to reach $700 billion in North America this year,2 issuer declines can result in huge revenue losses. Businesses lose revenues not only from initial rejected transactions but also from all the potential transactions that these customers might have completed in the months and years to come. Customers know another retailer is always just a click away.

Reaching the next frontier in fraud management

Recapturing lost revenue requires closing the gap between card-not-present and card-present authorization rates. Businesses and issuers should have better ways to accept more good orders in card-not-present scenarios. By guarding against issuer declines, businesses could capture more revenue now and build customer loyalty, possibly leading to more sales in the future.

Cybersource is helping blaze the path to this next frontier in fraud management. Our revenue capture initiative has five pillars that are geared toward helping businesses and issuers maximize revenues by increasing authorization rates for card-not-present transactions. Since these are in-process developments, I must include the fact that specific implementation details are subject to change or cancellation.

- Authorization analytics: Businesses should know how their authorization rates compare to industry peers so they can set goals and gauge improvements. We’re working on adding authorization metrics to new Cybersource Decision Manager Enterprise Business Center reports to provide these insights.

- Intelligent payment routing: We’re developing intelligent payment routing capabilities that use machine learning to match processors with transactions, providing the highest likelihood that each transaction will be authorized.

- Improved decision-making: We’re incorporating additional tools and data feeds for the most risky transactions, which will enable both businesses and issuers to make better decisions and reduce manual reviews.

- Self-tuning: Decision Manager will be the master orchestrator to continuously and automatically fine-tune the authorization process. We’re using best-in-class analytics and reporting capabilities to create self-tuning feedback loops, which can help optimize tool configuration and ultimately improve transaction completion rates.

- Issuer data exchange: We’re moving fraud screening prior to authorization and working to enable passing additional risk assessment information in the future to issuers so they can make more informed decisions about card-not-present transactions—and hopefully decline fewer of them.

Improving the present and future of fraud management

Some of these pillars point to where we are headed in the future. However, many businesses are already benefiting from Cybersource fraud management tools and services today—not only to reduce chargebacks and enhance operational efficiency, but also to improve card-not-present authorization rates, reduce manual reviews, and ultimately capture more revenue.

For example, one large North American retailer drove down rejected orders by 34 percent and increased eCommerce revenues by 30 percent in just one year by working with Cybersource. Another reduced rejected orders by nearly 50 percent and boosted accepted revenue by more than 10 percent in a single year. These are the types of results that can have a transformational effect on companies.

Learn how Cybersource fraud management tools can help your business.

2eMarketer, Retail Ecommerce Sales in North America, December 2018.