Why do so many businesses with an online presence trust tokenization to help protect sensitive card information—and reduce the scope and costs of PCI DSS compliance?

The Payment Card Industry Data Security Standard (PCI DSS) sets a baseline of standards to protect consumers and their personal data and to ensure businesses are following best practices security standards across the payments ecosystem globally. Since it applies to any organization that accepts or processes payment cards, your business may need to ensure it complies.

A tokenization service, such as Cybersource Token Management Service, can help your online business reduce its PCI DSS compliance scope and costs by allowing you to offload a significant portion of the compliance to a trusted third party.

What is tokenization?

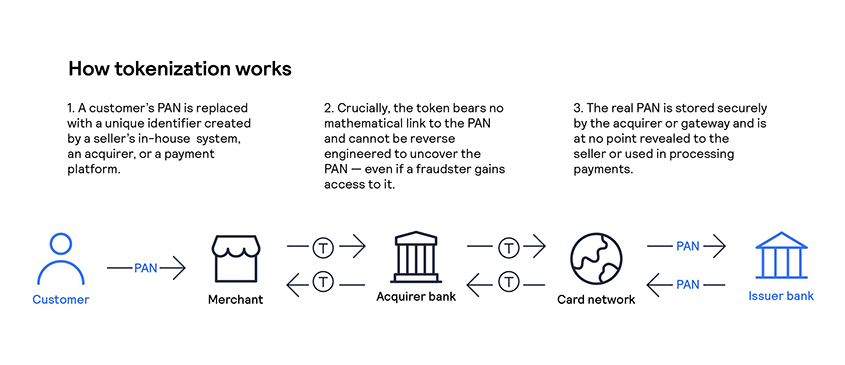

Tokenization replaces a customer’s sensitive personal account number (PAN) with a unique digital identifier, while the real PAN data is securely stored. Even if the token is compromised, it can't be reverse-engineered to recover any data—so is meaningless and can't be used.

How does tokenization simplify your PCI DSS compliance?

Tokenization can support your business in the three key areas of PCI DSS compliance.

1. Secure collection and transmission of customers' payment card data

Handling card data yourself could mean you have to meet 300+ PCI DSS security controls. That could involve buying, installing, and maintaining security hardware and software. Tokenizing personal account numbers (PANs) and storing the real PAN data does away with a great deal of complexity, risk, and cost.

2. Secure storage of payment card data

If you handle or store card data, PCI DSS requires you to define the scope of your cardholder data environment, to which all 300+ security controls apply. Using tokenization, however, means that the card data never touches your servers. So you significantly reduce your PCI DSS compliance scope, and therefore your costs. With Cybersource Token Management Service your customers' card data is stored in Visa's enterprise-level, tier-4 data centers—the highest level of security used for sensitive payment data.

3. Annual validation that the required security controls are in place

No matter how your business accepts card data, you must complete a PCI validation form every year. If you outsource the payment processing and cardholder data functions of your card-not-present channels to a PCI DSS-compliant service provider like Cybersource—a certified Level 1 PCI DSS service provider—you lessen the scope of your annual PCI validation exercise. Another way to save money, time, and effort.

How else does Token Management Service streamline PCI DSS compliance?

Cybersource Token Management Service is the only service of its kind that links tokens from different networks, issuers, and channels into a proprietary super token. So when it comes to PCI DSS compliance, you don't have to manage or maintain multiple network token systems to prove PCI compliance—almost everything is done for you.

Token Management Service can help boost loyalty—and revenues

Because Cybersource’s proprietary super token links other tokens together, it gives you a 360-degree view of each customer's shopping habits, which can help you:

- Boost revenues by creating better shopping experiences, lifting authorization rates, avoiding lost revenue from expired cards, and reducing fraud.

- Increase customer loyalty by offering seamless payment experiences and personalized loyalty and promotional opportunities across channels and payment types.

Our Token Management Service is so trusted that more than six billion Cybersource tokens are in use throughout the world securing sensitive payment data.1 The service easily integrates with other powerful Cybersource tools including Decision Manager, Payer Authentication, Account Takeover Protection, Recurring Billing, and Global Gateway.

To learn more about the benefits of payment tokenization, download our guide.

1 Cybersource Token Management and Secure Storage token payment volume from Oct. 1, 2020 to May. 31, 2022.