decrease in fraud-to-sales ratio2

Razorpay is one of India’s largest payment facilitators. Since 2022, we’ve been working with them to integrate Cybersource fraud-management technology into their merchant-facing solutions. They wanted to help merchants accept cross-border payments with confidence and without the typical concerns about fraud. In the process, we’ve helped Razorpay drive loyalty among its merchants, tap into a growing revenue stream, and differentiate itself in the market.

Opportunity: turning cross-border purchases into cross-border opportunities

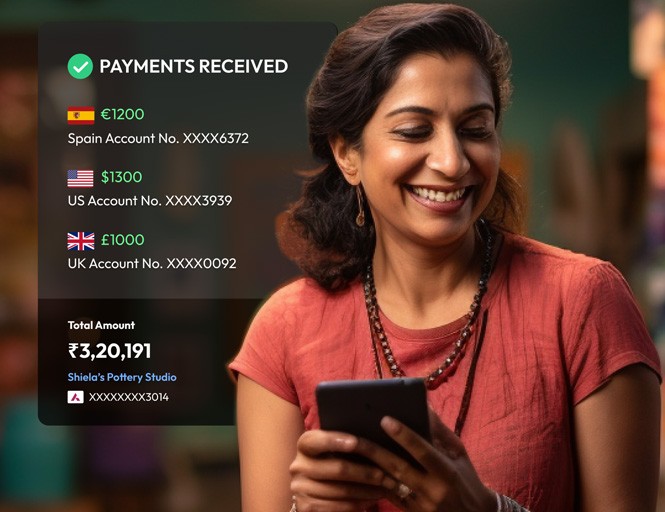

As India continues to grow as a global commercial hub, cross-border transactions are an important opportunity for Indian merchants of all sizes. However, compared with domestic transactions where second-factor authentication is virtually standard, most cross-border payments have no additional authentication. As a result, they are where most fraud occurs. It’s an issue Razorpay knows all too well. As one of India’s leading payment facilitators, they help more than 50,000 merchants process payments domestically and from all over the world.

Razorpay was looking for a solution and a partner who could help them better protect merchants from cross-border fraud and enable them to maximize cross-border opportunities with confidence.

What they needed was a fraud management tool that could identify fraud threats, wherever in the world they originated—something Cybersource Decision Manager and our team of Managed Risk Analysts are uniquely qualified to do.

What we did: machine learning and human expertise in unison

Cutting-edge technology backed by global data is central to any effective global fraud solution. But there’s nothing like human expertise to ensure the tech is working as hard as it can. Our fraud solutions always combine the two, and our solution for Razorpay was no exception.

Powerful machine learning with Decision Manager

Decision Manager is our fraud prevention and risk management tool. Powered by machine learning and AI tools such as Identity Behavior Analysis, it allows businesses to deploy strategies based on learnings from 141 billion transactions worth of insights from across VisaNet.1

For the first few months of our engagement with Razorpay, Decision Manager ran alongside their existing fraud management solution. When it quickly became clear Decision Manager was more effective, Razorpay integrated it into their merchant-facing solutions.

Next-level customization for merchants

A unique benefit of Decision Manager is its transparency. For the first time, Razorpay’s team was able to see what was causing approvals and rejections. They could create customized rules by categories, verticals and transaction values, and even specific merchant models at a portfolio level.

A dedicated expert

Decision Manager provides Razorpay with dashboards, reports, and direct access to investigate individual transactions. To turn all this data into actionable insights, we provided them with a dedicated Cybersource Managed Risk Analyst who helps them fine-tune Decision Manager and stay ahead of emerging fraud on a continuous basis with weekly touchpoints.

The difference we made: reducing fraud, improving loyalty

30%

Razorpay has seen its fraud-to-sales ratio fall dramatically while authorization rates remain high, showing they’ve cut fraud while continuing to let genuine customers through.

40%

decrease in chargebacks2

In line with the reduction in fraud, Razorpay’s customers now deal with far fewer chargebacks

18%

reduction in false positives2

Fewer legitimate transactions are incorrectly flagged as fraudulent, resulting in an enhanced customer experience, increased approval rates, and improved revenue growth.

Improved customer loyalty

The ability to reduce cross-border fraud has given Razorpay a unique differentiator in the market. It’s driving confidence and loyalty among their existing merchants and helping to attract new merchants interested in more cross-border business.

A foundation for innovation

From chargeback protection to next-level device fingerprinting on merchant-hosted checkouts, Razorpay is now in a position to build on their solution with continuous innovation for their merchants.

Increased in-house capabilities

Razorpay isn’t just seeing lower fraud. Thanks to the transparency and insights available through Decision Manager, they now have better control and management, enabling them to make more proactive decisions.

1 VisaNet transaction volume based on 2021 fiscal year. Domestically routed transactions may not hit VisaNet.

2 Calculated by comparing Razorpay data year-over-year for January to August 2023 and January to August 2022.

Disclaimer Note:

The statistics in this section are made available by Razorpay. Visa does not make any representation or warranty about its completeness or accuracy and is not responsible for your use of or reliance upon the information contained herein, including errors or inaccuracies of any kind.

“As Is” Disclosure

Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Cybersource neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required

Third party brand identification notice

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Cybersource.