Flexible, tailored programs

What is Affirm?

Affirm offers customers a smarter way to pay with no hidden fees or surprises. By offering flexible payments, businesses can expand customer reach and increase average order value for impactful, sustainable results.

Why Affirm?

Capture more sales with Affirm’s pay-over-time technology and omnichannel solutions.

Premium customer network

Tap into Affirm’s premium network of high-intent shoppers.

Proven retention model

Increase average order value, customer satisfaction and retention by offering shoppers flexible payment plans with terms proven to boost conversion.

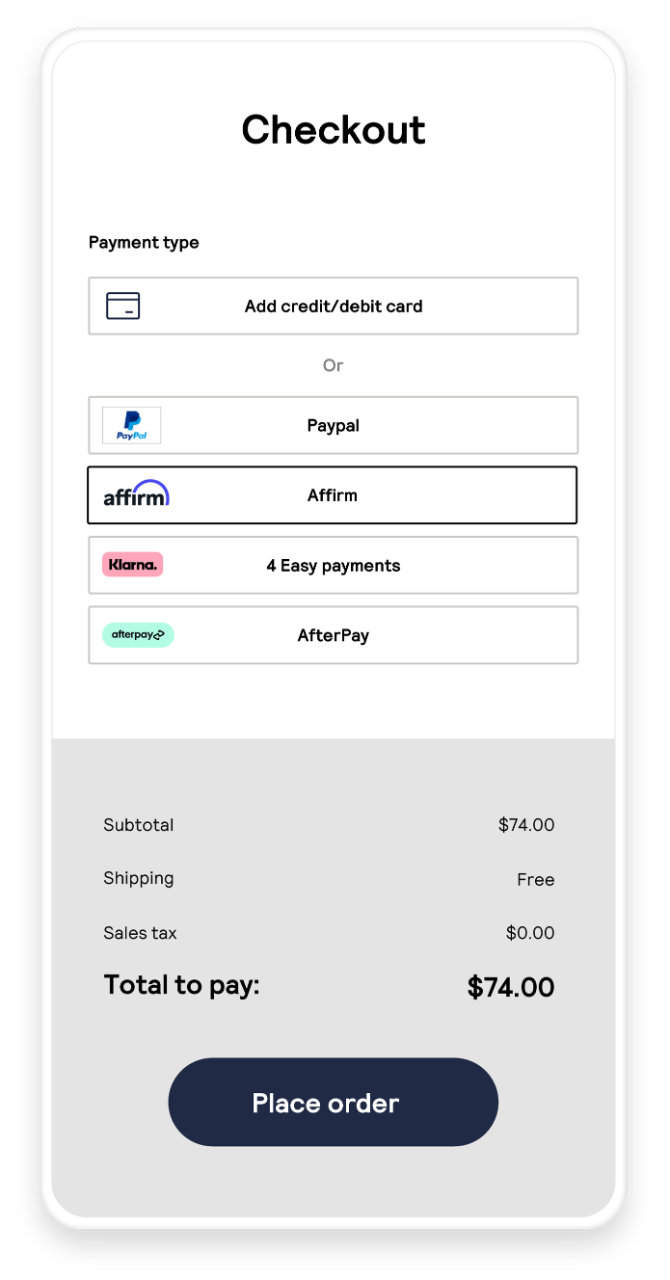

How does Affirm work?

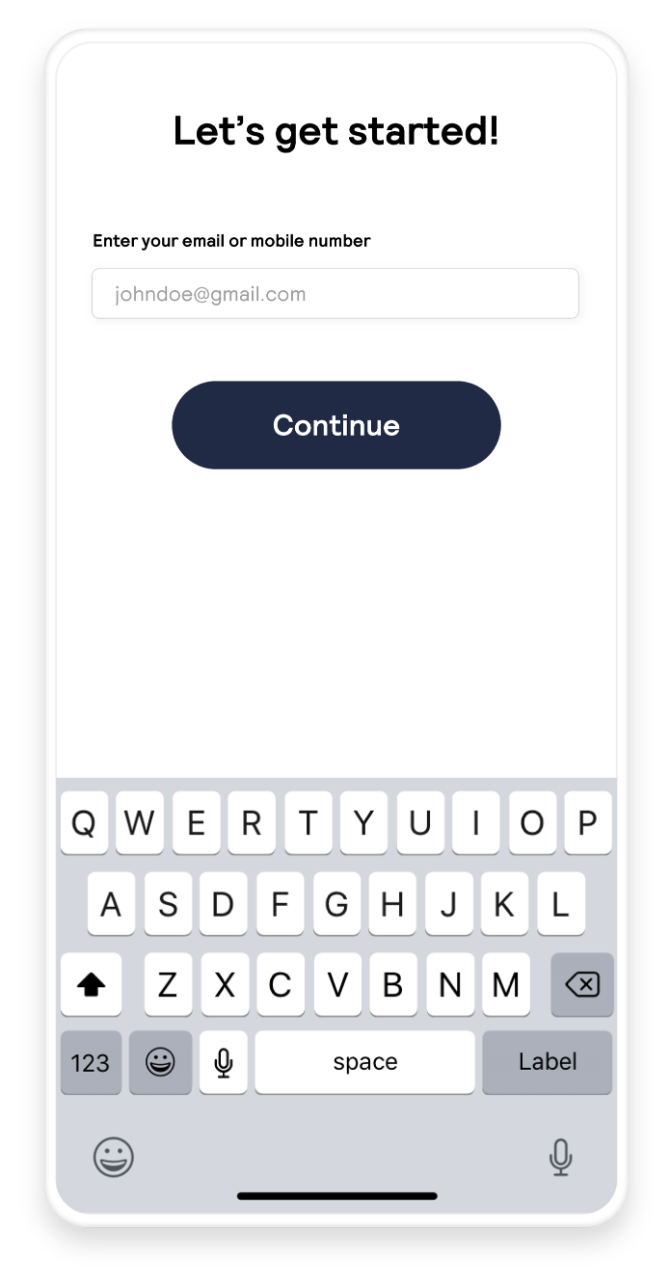

1. At checkout, the consumer selects Affirm as their payment method.

2. The consumer provides a few basic details to apply.

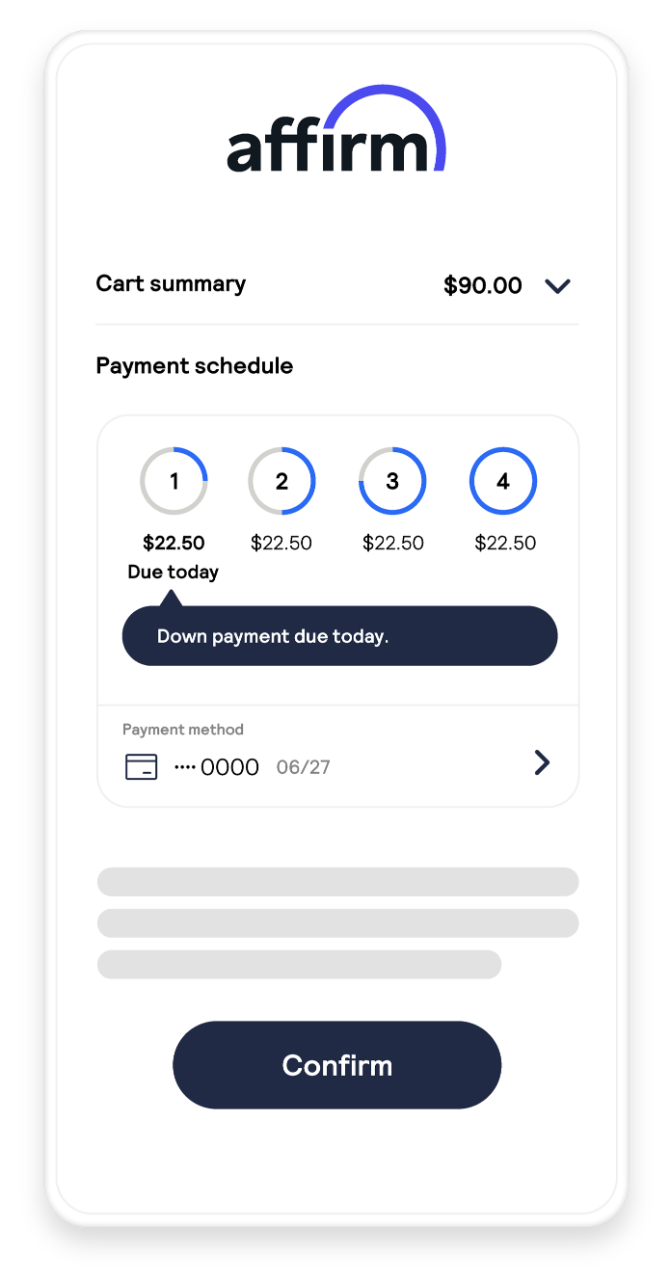

3. If approved, the consumer will see available payment options and choose their preferred plan to confirm the transaction.

4. The merchant and consumer are notified of the successful transaction.

More about Affirm

| COVERAGE | |

|---|---|

| Consumer | U.S. |

| Merchant | U.S. |

| CURRENCIES | |

|---|---|

| Consumer | USD |

| Processing | USD |

| Settlement | USD |

| TRANSACTIONS | |

|---|---|

| Minimum | $50 |

| Maximum | $30,000 |

| APR | 0-36% |

| Term length | 6 weeks to 60 months |

| Timeout | N/A |

| FEATURES | |

|---|---|

| Recurring payments | |

| Refunds | |

| Partial refunds | |

| Multiple partial refunds | |

| Payment assurance | |

| Chargeback risk1 |

|

| One-click payments |

1 Affirm assumes all consumer risk

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Cybersource.