Global consumer base

What is Klarna?

Klarna is one of the market leaders in buy now, pay later services. It offers three payment methods: Pay now, Pay later, and Financing. With Pay later, consumers have the option to pay within a set amount of days or pay in interest-free installments.

Why Klarna?

More than 140 million consumers used its services in 45 countries.1

Widespread acceptance

In 2021, Klarna had more than 400,000 global retail partners that helped them deliver a seamless shopping experience.1

Boost sales and loyalty

Klarna can increase purchase frequency and conversion for consumers using Pay later.

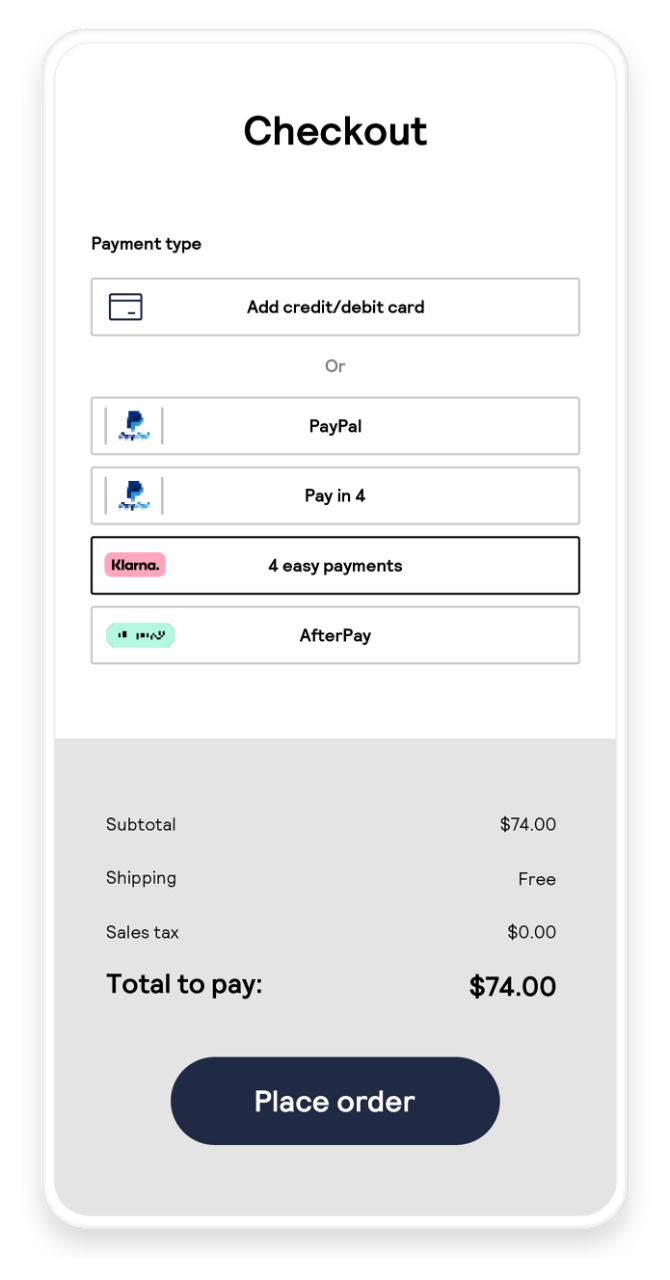

How does Klarna work?

1. At online checkout, the consumer selects Klarna as their preferred payment method.

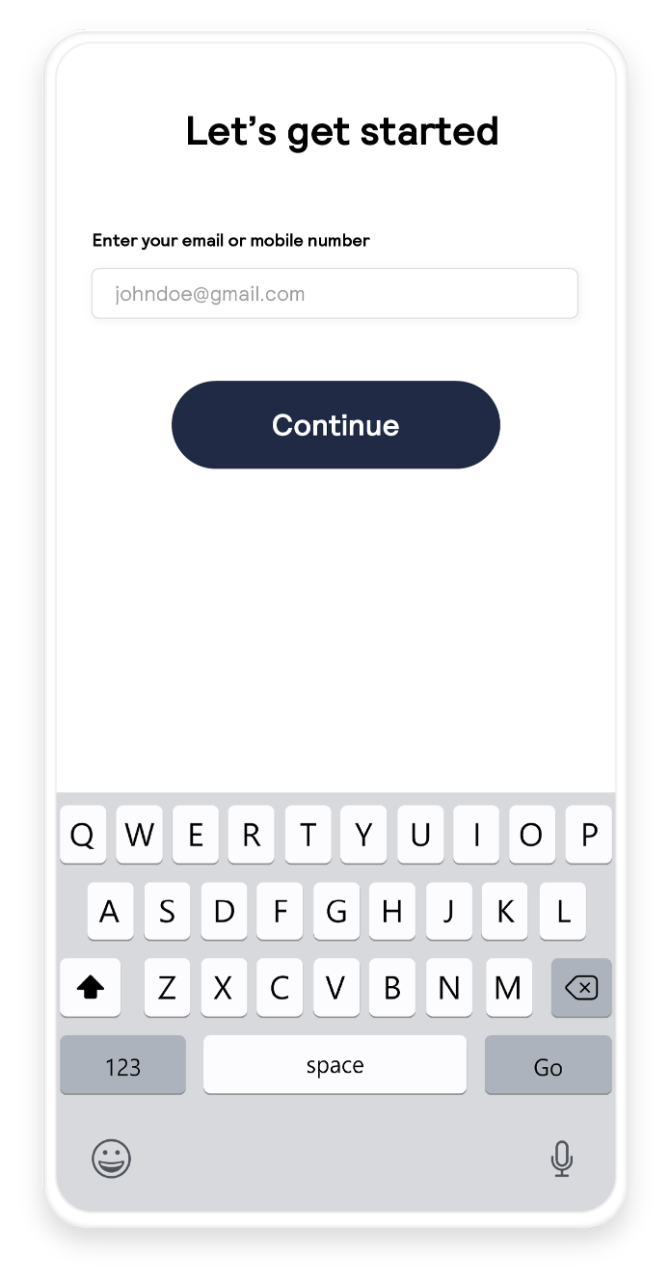

2. The consumer enters contact information.

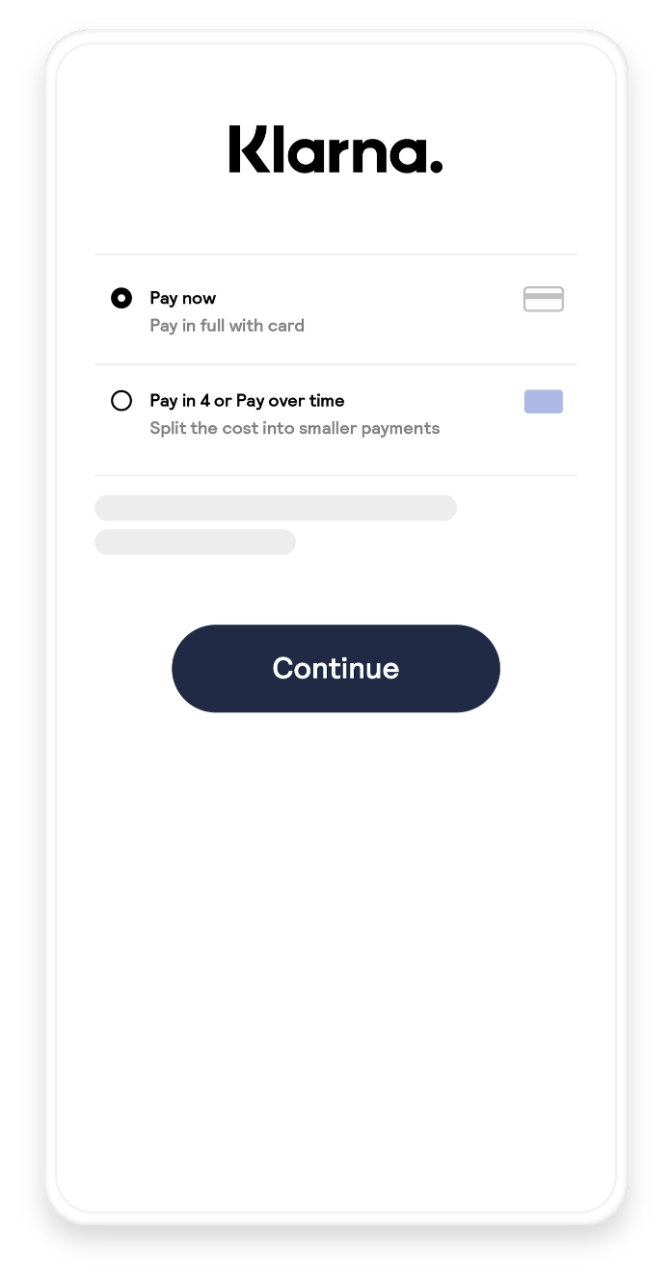

3. The consumer chooses their preferred plan, enters the required personal details, and confirms the transaction.

4. The merchant and consumer are notified of the successful transaction.

More about Klarna

| COVERAGE | |

|---|---|

| Consumer | Austria, Belgium, Canada, Czechia, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Mexico, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Spain, Sweden, Switzerland, United Kingdom |

| Merchant | Global |

| TRANSACTIONS | |

|---|---|

| Minimum | CAD, CHF, CSK, DKK, EUR, GBP, MXN, NOK, PLN, ROM, SEK, USD 0.01 |

| Maximum | CAD, CHF, CSK, DKK, EUR, GBP, MXN, NOK, PLN, ROM, SEK, USD Klarna sets the maximum |

| Timeout | 48 hours |

| CURRENCIES | |

|---|---|

| Consumer | CAD, CHF, CSK, DKK, EUR, GBP, MXN, NOK, PLN, ROM, SEK, USD |

| Processing | CAD, CHF, CSK, DKK, EUR, GBP, MXN, NOK, PLN, ROM, SEK, USD |

| Settlement | CAD, CHF, CSK, DKK, EUR, GBP, MXN, NOK, PLN, ROM, SEK, USD |

| FEATURES | |

|---|---|

| Recurring payments | |

| One-click payments | |

| Refunds | |

| Partial refunds | |

| Multiple partial refunds | |

| Payment guarantee | |

| Chargeback risk |

1 Klarna Annual Report 2021, page 3

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Cybersource.