Flexible payment options

What are Afterpay and Clearpay?

Afterpay (also known as Clearpay in the United Kingdom) is an Australia-based buy now, pay later service provider offering flexible shopping and purchase experiences. It allows customers to split payments into four instalments over six weeks for both online and in-store purchases.

Why Afterpay and Clearpay?

Consumers have flexibility with their purchases using Afterpay’s pay-in-four financing with no interest.

Boost sales and loyalty

Merchants can increase in average order value and frequency for consumers that use its services.

Global consumer base

More than 16 million active global customers used its services.1

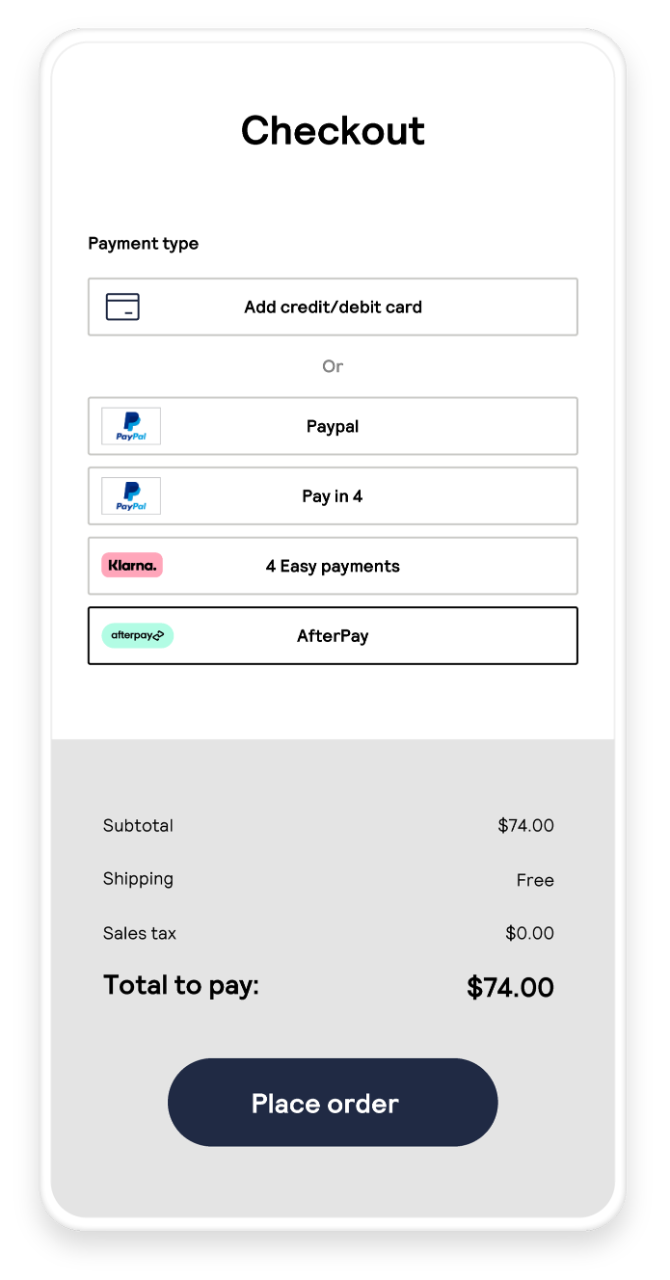

How does Afterpay work?

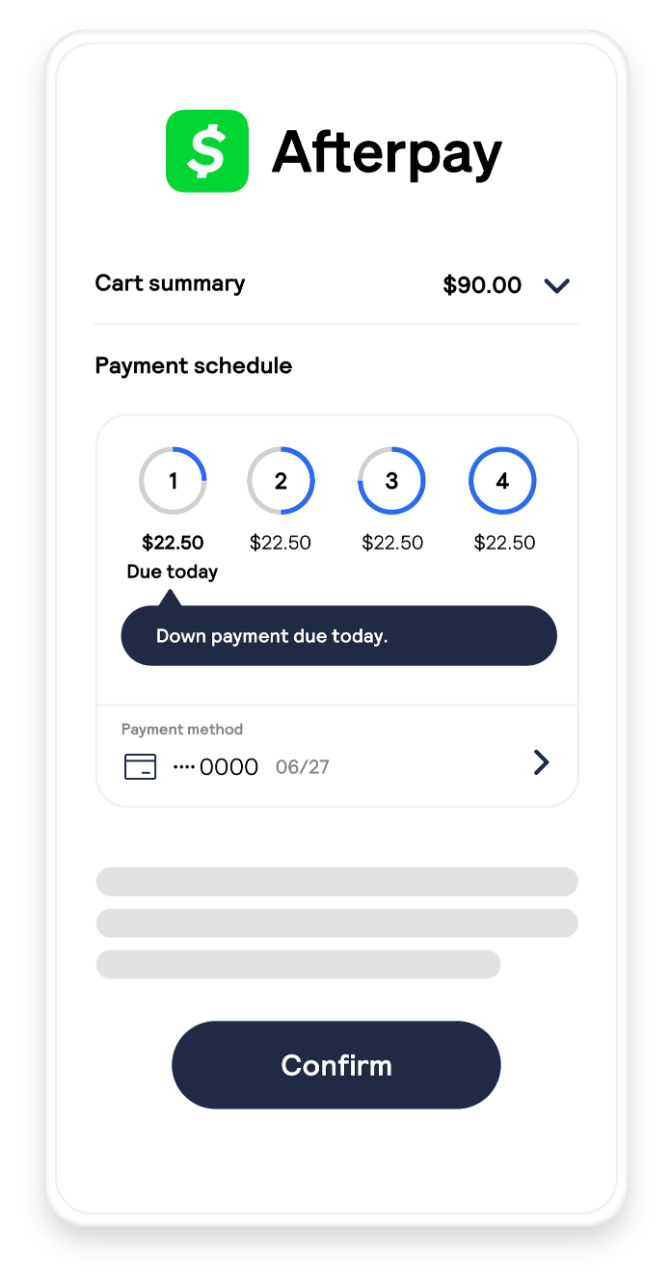

1. At online checkout, the consumer selects Afterpay as their preferred payment method.

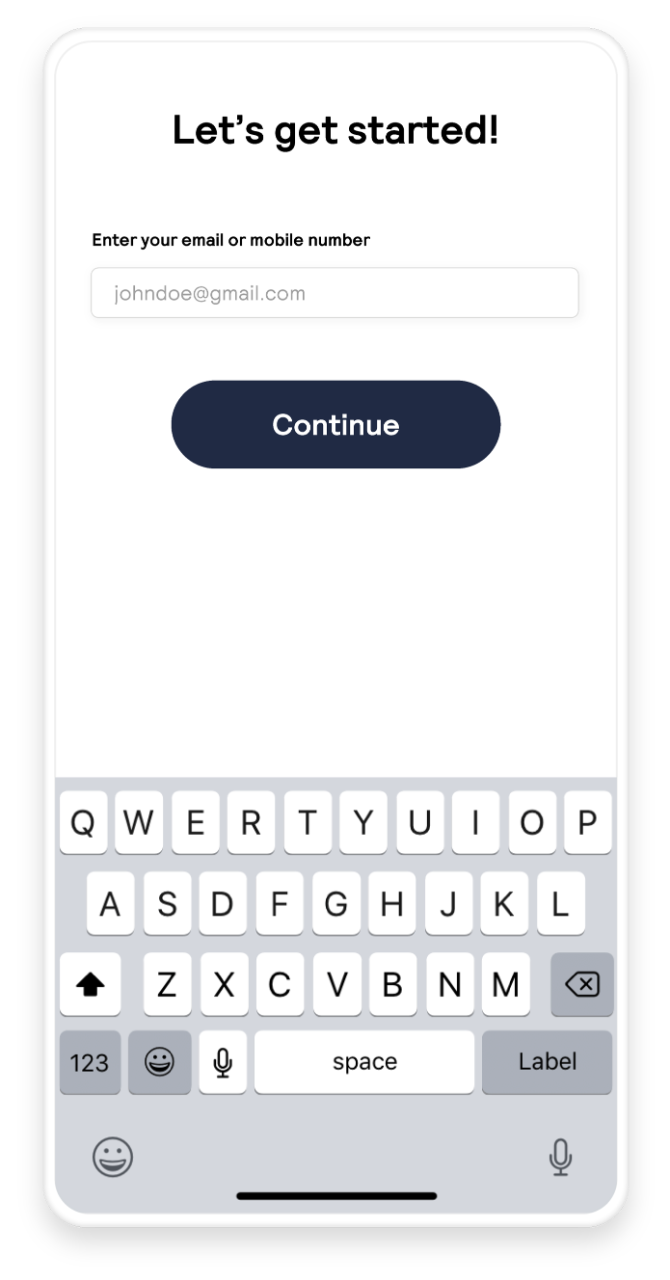

2. The consumer enters contact information.

3. The consumer chooses the preferred plan, enters the required personal details, and confirms the transaction.

4. The merchant and consumer are notified of the successful transaction.

More about Afterpay and Clearpay

| COVERAGE | |

|---|---|

| Consumer | United States, Canada, New Zealand, Australia, United Kingdom (Clearpay) |

| Merchant | Global |

| CURRENCIES | |

|---|---|

| Consumer | GBP |

| Processing | GBP |

| Settlement | GBP |

| FEATURES | |

|---|---|

| Recurring payments | |

| One-click payments | |

| Refunds | |

| Partial refunds | |

| Multiple partial refunds | |

| Payment assurance | |

| Chargeback risk |

1 Afterpay Annual report, 2021

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Cybersource.