If you’re looking to scale your business, you may well be thinking about expanding internationally. Advances in technology are making it possible for more companies to grow beyond their national borders. But, as you may have already discovered, entering a new market is not without its challenges.

Along with ensuring there’s a demand for what you offer, you’ll need to invest time researching local audiences, competitors, customs, regulations, compliance, supply chains, partner ecosystems, and more. There’s a lot to consider, so it’s no wonder that companies often overlook the one thing that can give them a vital edge in new markets: a localized payments strategy. Hear why incorporating localized payments is so important from Visa Senior Director of Client Success Jennifer Zessin.

That’s why it’s worth looking at the 2023 Global Digital Shopping Index (GDSI) report. It shows how you can use local payment methods to empower your growth strategy. There are four key areas critical to growing scale worth examining:

One size doesn’t fit all

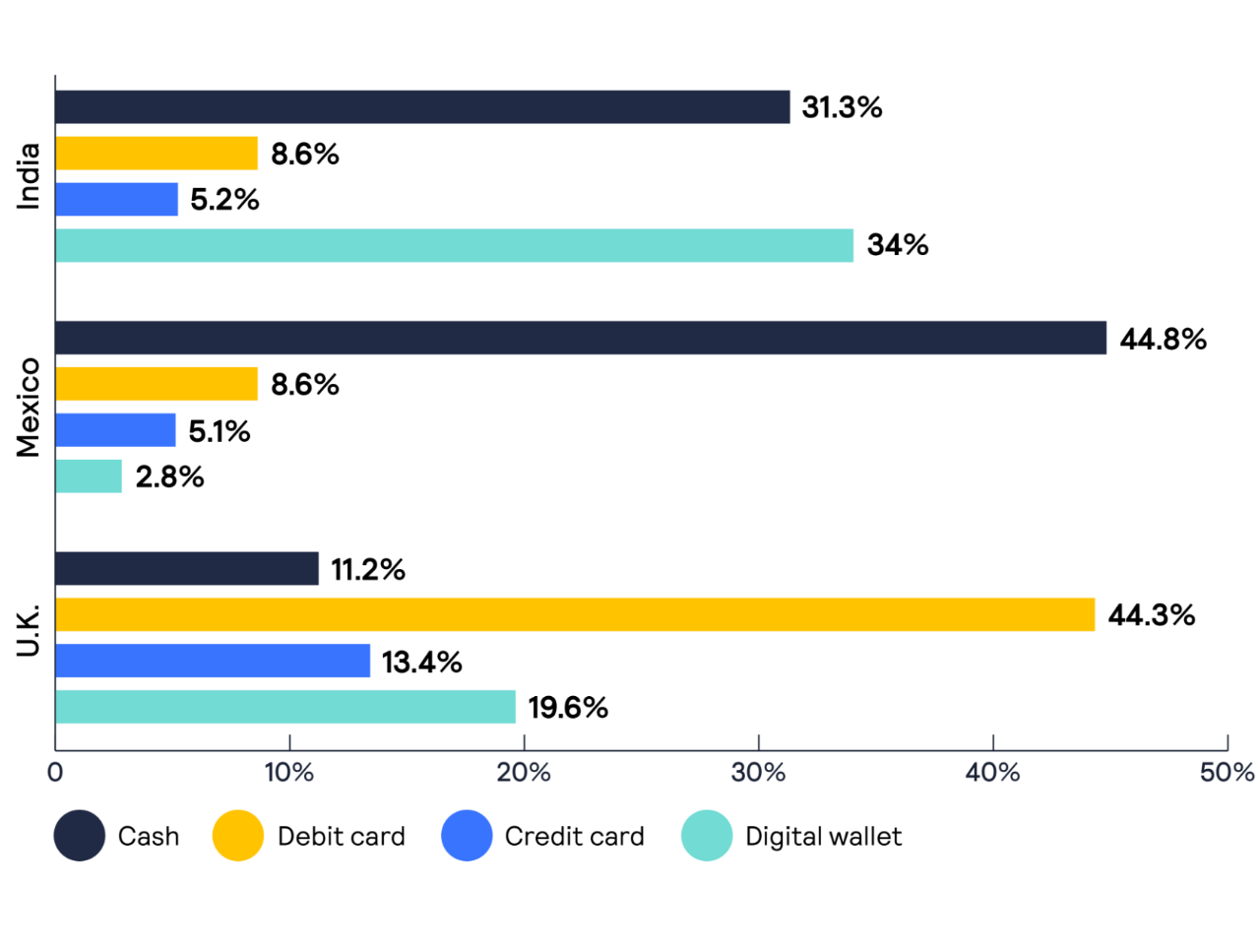

Understanding and adopting popular local payments can help you access the largest audience possible in a new market. Payment preferences can differ from country to country. What’s popular in your country may not even be available in the markets you’re looking at. To win over shoppers in new markets, you need to deliver preferred local shopping and payments methods. For instance, in Brazil you may want to offer PIX, in India Paytm,1 and it seems vital to accept contactless debit cards in the UAE.1

This snapshot of payment preferences in three of the report's surveyed countries demonstrates the vast differences between markets.

Credit and debit cards: the same but different

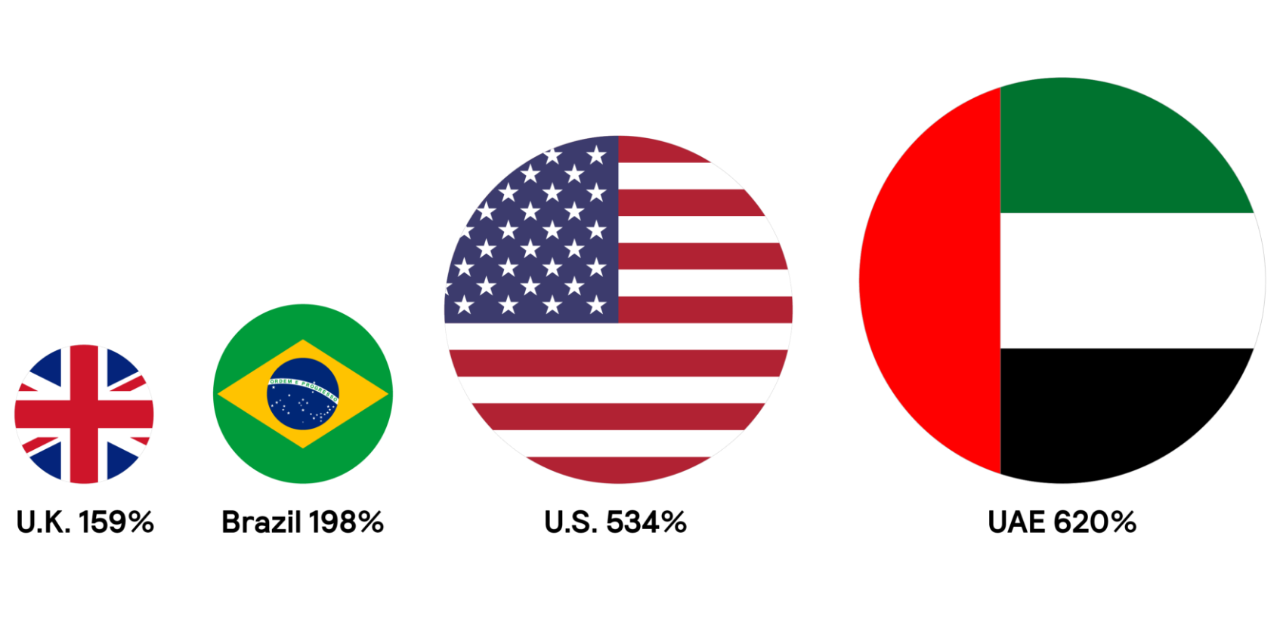

When it comes to payments, many people like familiarity, so no prizes for guessing that credit and debit cards remained shoppers’ preferred in-store payment methods in almost every market.1 However, there’s been a dramatic shift and huge increase in the use of debit cards thanks to the adoption of contactless technology.

Around the world, contactless debit card use grew in 2022 with some markets seeing phenomenal growth.

Digital wallets: another opportunity to help your business scale

The growing popularity of digital wallets is another way to maximize your customer base when expanding internationally. Just as each country can have its own native tongue, it can also have its own preferred payments, including digital wallets. Understanding which are the most popular can give you an advantage when opening in a new market.

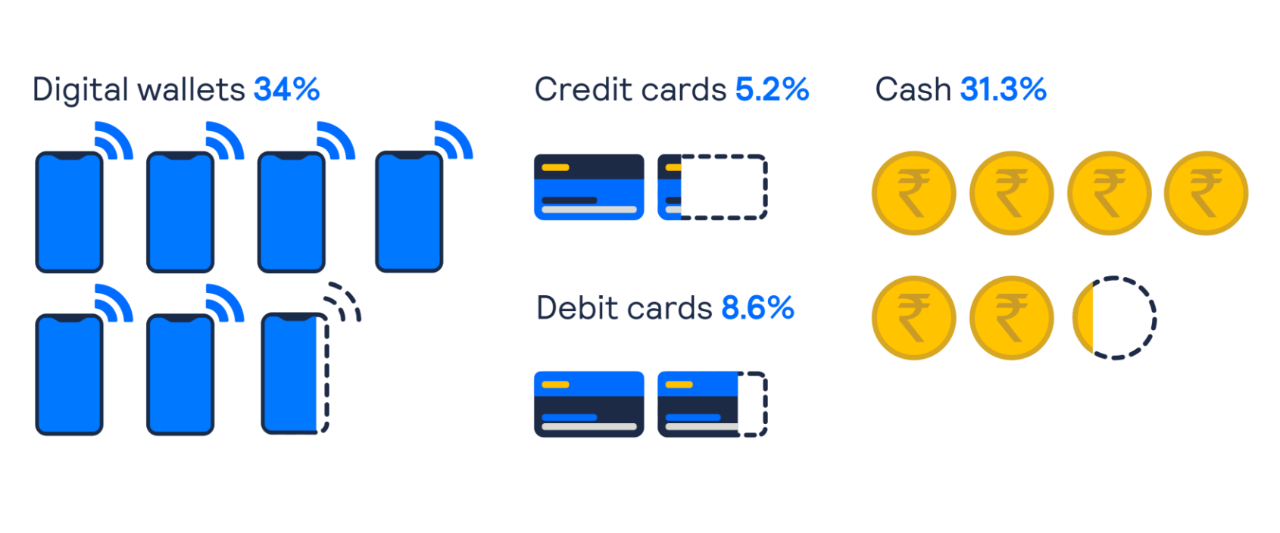

Use of digital wallets doubled in the UAE and tripled in the U.K. Even in Mexico, a traditionally cash-based economy, digital wallet use rose 27%, while cash fell 23% in 2022. One country that really stands out is India. Here, 34% of the population used a digital wallet in-store and 60% used one when shopping online. In just 12 months, Indian digital wallet use with services like Paytm has outstripped cash, credit, and debit card use.1

India saw an astonishing adoption of digital wallets in 2022 for both online and in store shopping.

Offer more than just payment choices

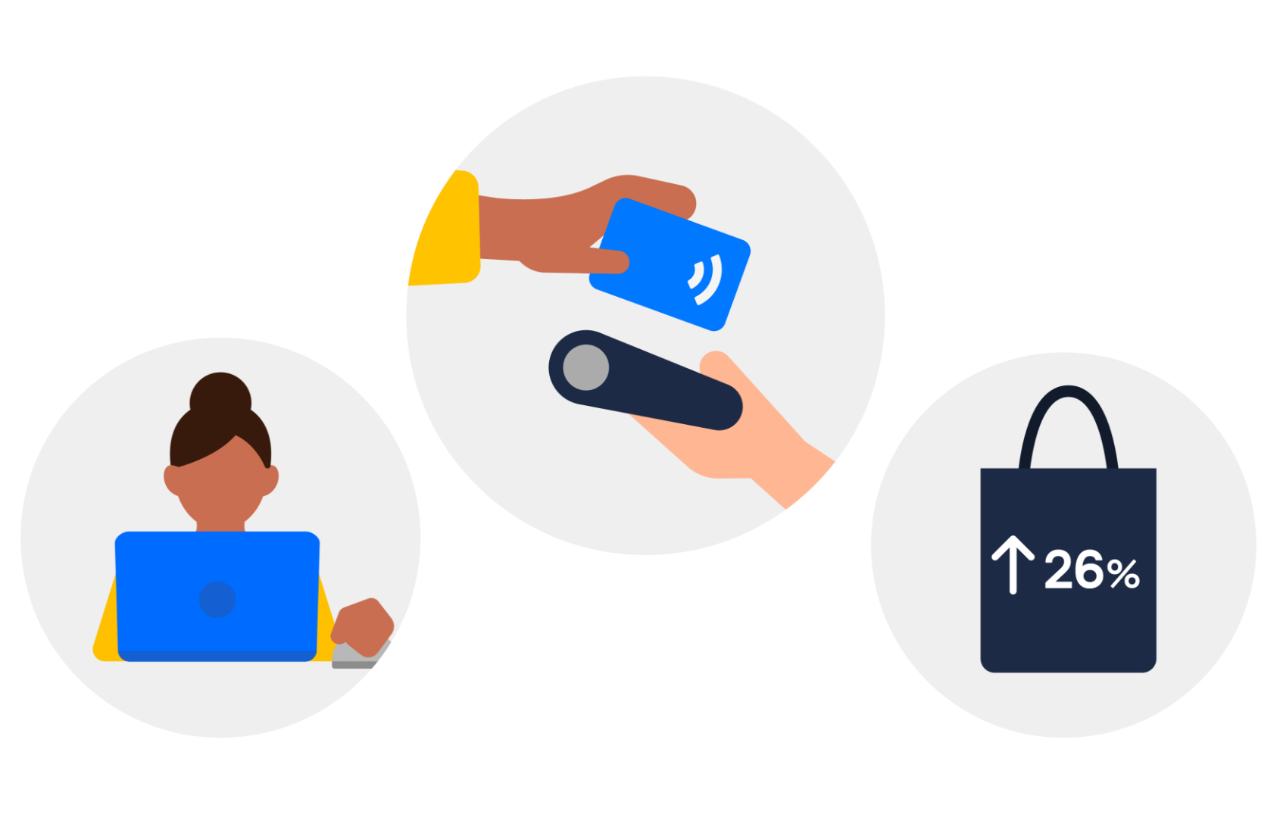

Mixing online convenience with in-store reassurance is another way to ensure you capture a larger audience, especially if you plan on opening physical stores.

Continuing problems with global logistics have left shoppers unsure of when, or even if, they’ll receive orders made online. But you can reassure customers by integrating pickup options into your order flow. BOPIS (buy online, pick up in store) and curbside collection grew by 26% in 2022, with almost a third of American shoppers (a 37% year-over-year increase) opting for the convenience of collection over the uncertainty, and extra cost, of home delivery.1 Offering pickup options may also help your business pick up more customers, as Jennifer Zessin, our Senior Director of Client Success, explains.

Grow scale by overcoming payment barriers

We’ve only skimmed the surface of how understanding local payment methods can give you a tangible advantage when looking to scale your business. Read the full 2023 Global Digital Shopping Index report and see how a localized payments strategy could be the key to your successfully scaling your business internationally.