Reduced fraud and chargebacks

PSD2 requires that all qualifying transactions must have Strong Customer Authentication (SCA) applied to them – unless an exemption can be applied.

To deliver the best SCA experience, it’s critical to minimise friction during the payment process – and keep your fraud rates low. This means:

- Making the SCA authentication process as smooth as possible

- Optimising your SCA exemption strategy—identifying out-of-scope transactions and requesting exemptions where relevant

One integration, double the benefits

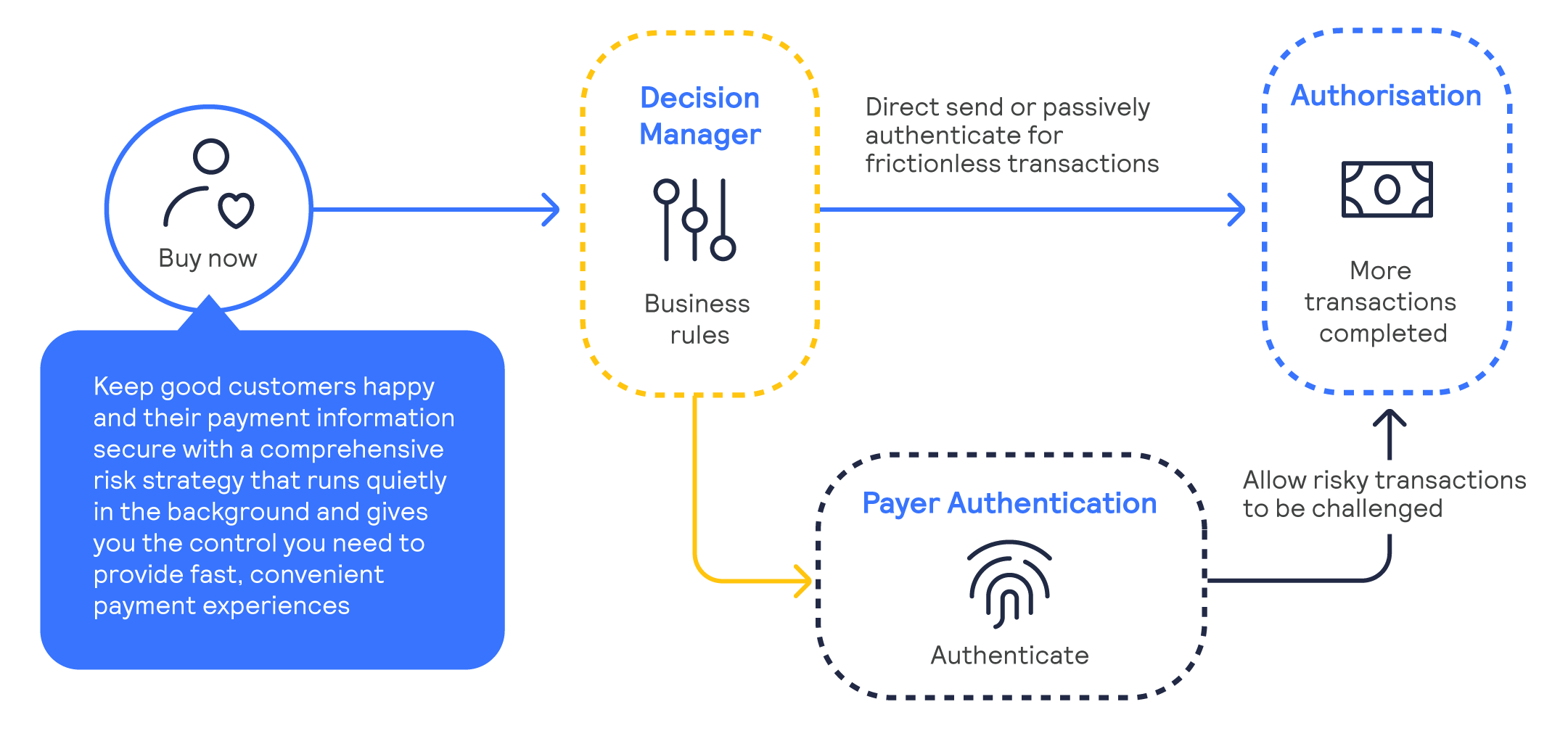

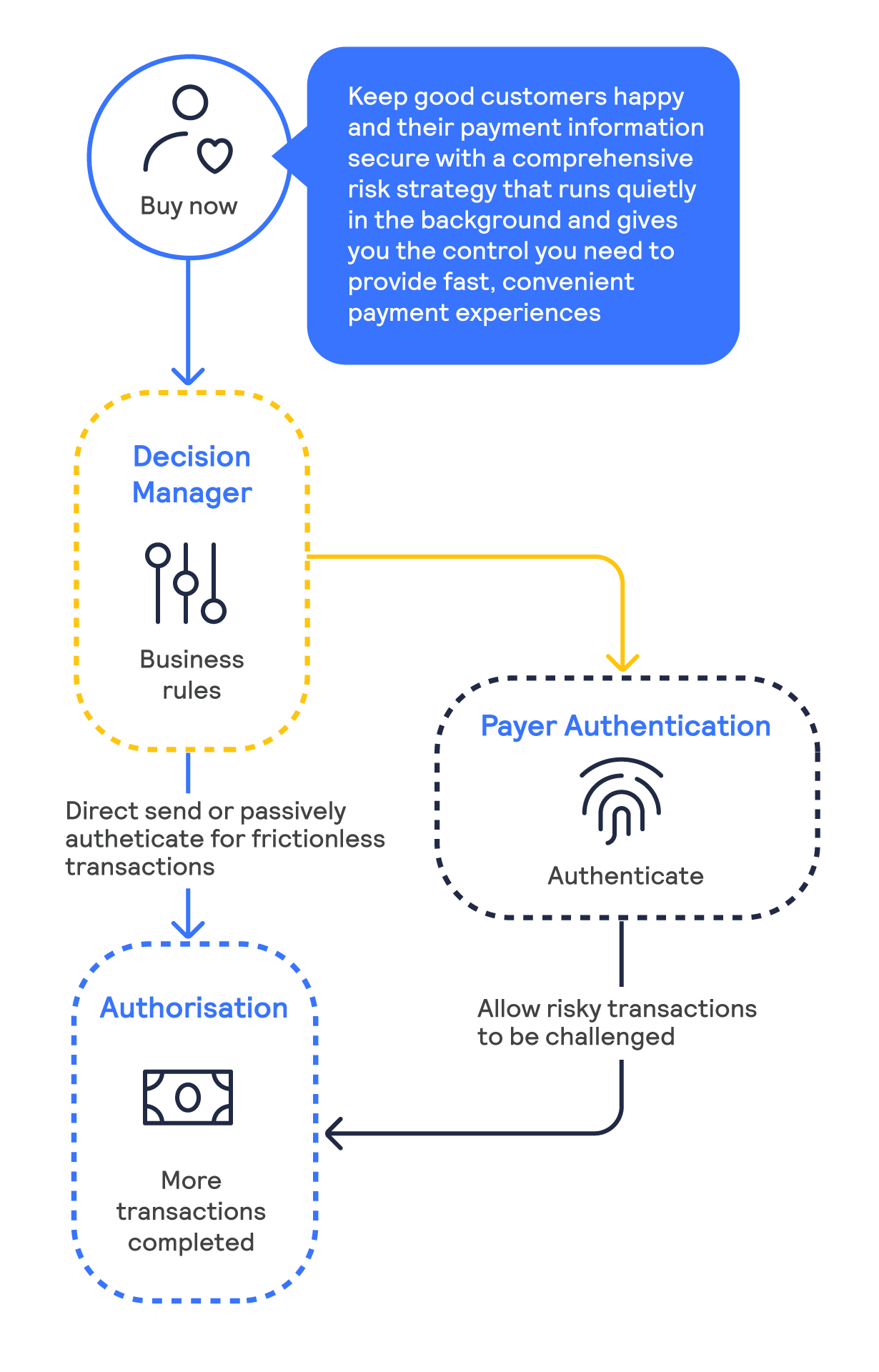

Decision Manager plus Payer Authentication screens transactions before they are submitted for authorisation—helping you recognise and flag transactions that are out of scope for SCA or may qualify for an SCA exemption.

Reject transactions before they are deemed too risky.

Benefits for your business

Maintain complete control over every part of your authorisation flow, and optimise SCA exemptions

By using Decision Manager to determine which transactions should flow through the authentication process before they’re sent for authorisation.

Raise authorisation rates by filtering out more bad transactions

Send higher-quality transactions through for authorisation, providing issuers with the additional information to make better risk assessments and approve more transactions.

Move liability for fraudulent transactions back to issuers

When you use Payer Authentication on qualified transactions, the issuing bank becomes liable for fraud-related chargebacks on those transactions.

Reduce chargeback rates

By attempting to block fraudulent transactions before they’re sent for authorisation. This helps to catch potentially problematic transactions before they have a chance to result in fraudulent chargebacks.

Protect your reputation

By providing customers with enhanced fraud prevention through every step of the transaction process.

Business rules allow you to optimise decision making

- Reject transactions before authorisation if they’re too risky.

- Invoke or suppress Payer Authentication based on order information.

- Identify transactions that are out of scope for SCA or may qualify for an SCA exemption.

- Bypass authentication for transactions where SCA isn’t required by the regulation.

- Use Payer Authentication results post-authorisation to reduce review rates.

Experience the Visa difference

As a Visa Solution, Cybersource enables you to:

- Streamline and accelerate your EMV®1 3-D Secure implementation by bringing all of your Payer Authentication and risk management components under a unified Visa umbrella.

- Take advantage of a proven and robust authentication network that supports tens of thousands of merchants and thousands of issuers, providing a rich source of payment data, and delivering 99.99 percent uptime.2

- Benefit from Visa’s membership in EMVCo, the standards body that develops and supports EMV® 3-D Secure, to stay a step ahead of the latest 3DS specifications.

Support PSD2 strong customer authentication (SCA) requirements

Cybersource can help to recognise and flag transactions that are out of scope for SCA and those that qualify for an SCA exemption.3

Risk management starts with Cybersource Decision Manager

Decision Manager is equipped to handle massive transaction volumes from worldwide customers and detect fraud using industry-leading machine learning models.

3DS authentication provides another layer of protection

Learn how Payer Authentication can be used with any fraud management tool to add 3DS authentication to your fraud strategy.

1 EMV® is a registered trademark in the US and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.

2 Cybersource has maintained 99.999 percent uptime for fiscal year 2021. Experience on the platform varies based on products and use.

3 Strong Customer Authentication (SCA) must be applied to electronic payments within the EEA and the UK unless the transaction is out of scope or qualifies for an exemption.

Interested? Let’s talk.

Find out how Cybersource Decision Manager plus Payer Authentication can help you to tap into the capabilities of 3-D Secure to reduce fraud, raise authorise rates and deliver better payment experiences.