Accurately detect fraud

The tools you need to start fighting common fraud attacks

Our midsize business solution, Fraud Management Essentials, has ready-to-go fraud filters that detect fraud, so you can automatically monitor every order to eliminate fraudulent transactions while still providing a seamless customer experience.

Fraud Management Essentials features

Powerful computer models use machine learning and hundreds of validation tests to detect fraud and automatically stop fraudulent transactions.

Accelerate your setup

Our fraud management tools come with a preconfigured settings screen for fraud, so you can get started right away.

Set up your fraud strategy

Tweak your settings easily with simple options that let you make changes based on your risk tolerance, and how many orders you’d like to push to review manually.

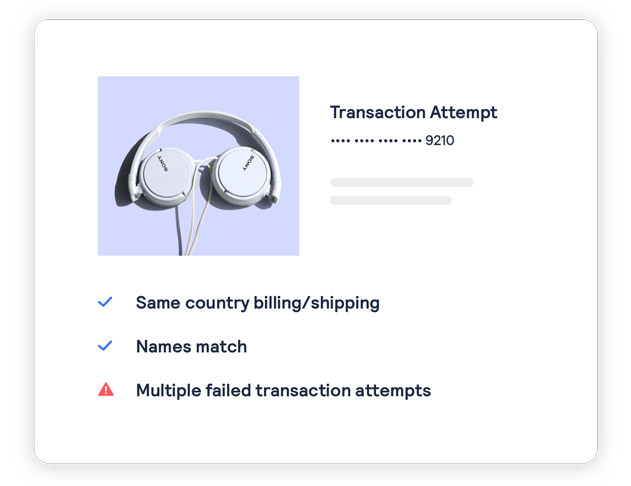

Make informed decisions

When orders are marked for review, the Fraud Management Essentials dashboard provides the data you need to accept or reject transactions.

Every business needs fraud protection

Although many businesses assume they’re too small to be noticed by fraudsters, they’re actually just big enough to be a primary, lucrative target.1 Having a small business fraud prevention strategy in place is vital to ensure you and your customers are protected from fraudulent transactions. Our credit card fraud protection gives you the tools you need to keep your business safe, without affecting customer experience.

Projected $130 billion in total losses

Over the next five years, analysts project that small and midsize businesses will be hit with more than $130 billion in losses due to payments fraud.2

$37,000 average loss

Payments fraud perpetrated on businesses with less than 49 employees result in an average loss of $37,258.14.3

Reduce common fraud attacks, without adding friction to checkouts

Fraud Management Essentials evaluates every transaction in milliseconds, so genuine customers can quickly make purchases.

Related fraud prevention products

Enterprise fraud protection

Automate your fraud screening with machine learning and customisable business rules.

Account takeover protection

Protect your customer accounts and loyalty programs from fraudsters.

Delivery address verification

Correct mismatched address information for 160+ countries and territories.

Payer Authentication for 3-D Secure

Payer Authentication allows you to take full advantage of all the latest authentication capabilities available through 3-D Secure.

eCommerce fraud protection trends

COVID-19 has changed the fraud landscape in unprecedented ways. From account takeovers to card testing, fraudsters have moved more activity online, resulting in in unauthorised or fraudulent transactions, stolen merchandise, or wrongful requests for refunds.

In this eBook, you’ll learn why eCommerce fraud is so prevalent, the nine types of eCommerce fraud, and most importantly, fraud management trends to help you stay ahead of evolving fraud attacks.

1 Research Report: Why fraud prevention is a strategic investment for businesses of all sizes. Emailage ©2019

This source was derived from a survey of 1,000 people in leadership roles in small to midsized businesses across the United States and Canada to learn about their attitudes towards fraud prevention.

2 Jupiter Research, Online Payment Fraud: Emerging Threats, Segment Analysis & Market Forecasts 2018-2023.

3 Small Business Fraud Report, Vocalink, January 2018 The Vocalink Analytics Small Business Fraud Report was conducted amongst 50+ small businesses in the UK and U.S. from October 9-16, 2017, by Populus on behalf of Vocalink Analysis.