Transactions

Fraud and risk management that pays off for you and your customers

Add fraud protection to your solution with Decision Manager. Reduce costs for your merchants and deliver the experiences their customers expect.

Fraud protection that creates value for you and your merchants

Earn revenue through increased customer value and loyalty, and referral incentives. Increase revenue for your merchants by reducing fraud.

What differentiates Decision Manager?

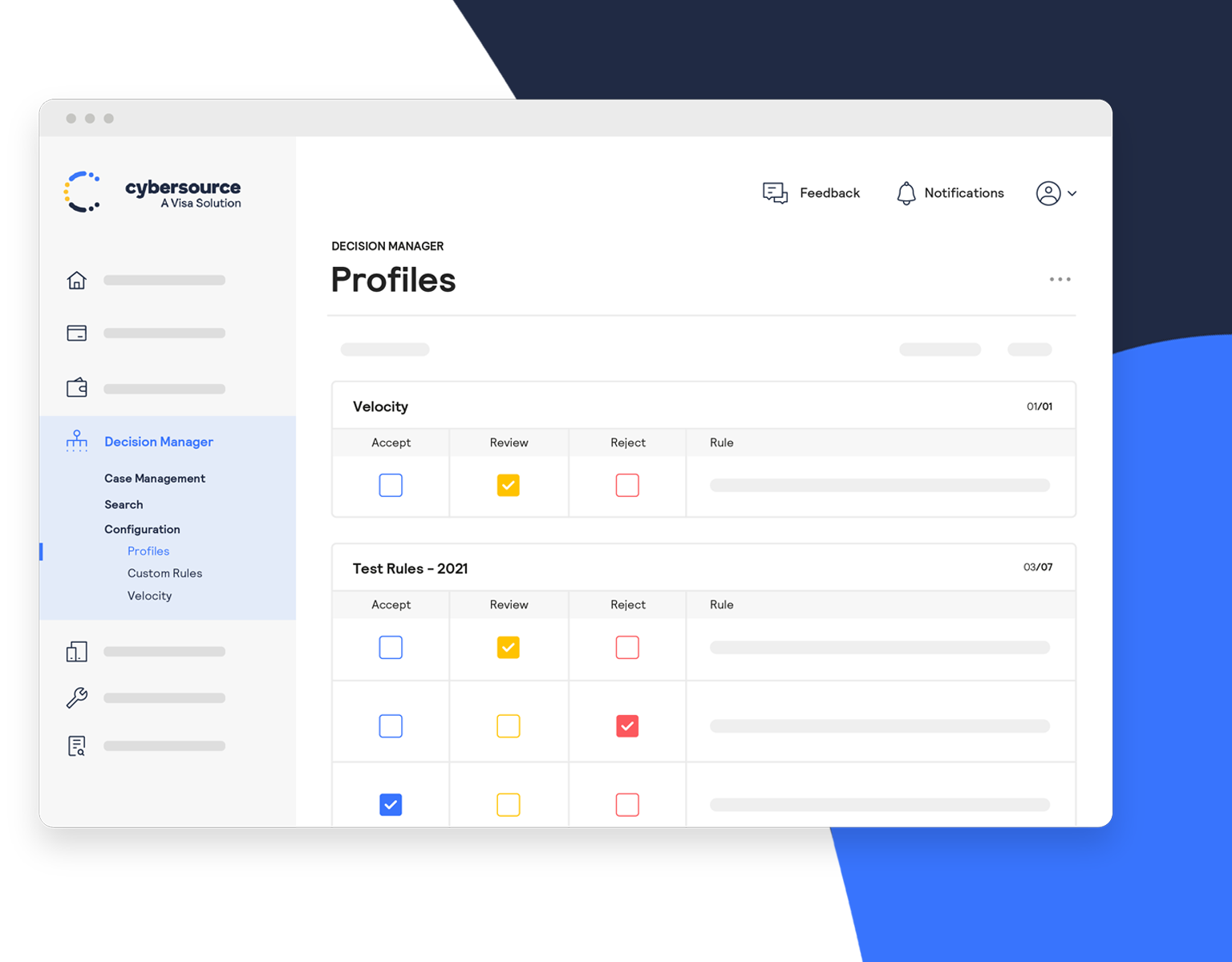

Decision Manager’s machine learning capabilities combine automated strategy suggestions with a “what if” testing environment. You can optimize your fraud strategy, then roll it out once you’ve defined the best approach for your business.

Automated suggestion engine

Rules Suggestion Engine applies Decision Manager’s advanced machine learning models to your historical transaction data to spot unique patterns and recommend new strategies.

Decision Manager Replay

With Decision Manager Replay, you can test the effect of fraud strategies against your historical transaction data in minutes with a “what if” analysis—helping you gauge how things would play out in the real world.

Trust Decision Manager for the fraud protection your merchants need

Decision Manager is a Visa-owned fraud solution, fully integrated with all of its systems, data and analytics—plus 20+ years of experience and insights:

141B

Insights from more than 141 billion VisaNet transactions.1

99.9%

Uptime

The global reach and advanced capabilities of the Visa ecosystem, with an uptime of 99.999%.2

600ms

Average screening time

Average transaction screening times of less than 600ms.1

2.2B

1 VisaNet transaction volume based on 2020 fiscal year. Domestically routed transactions may not hit VisaNet.

2 Data is measured and validated from internal instance of Tableau Server based on payment volume from the Cybersource and Authorize.net Product Fact data source. Provided by payment processing product team. Data is measured and validated from internal instance of Tableau Server based on billable transactions from the Cybersource and Authorize.net Transaction Fact data sources.

3 Represents the number of payments processed through Decision Manager in 2021 calendar year.

More good payments = more revenue

False positives weaken customer loyalty and hurt your business. Decision Manager keeps fraud low, satisfaction high, and revenue flowing as your business grows and evolves.

Deep expertise + data-driven insights = more good payments and fewer fraudulent transactions.

What’s included

Data-rich machine learning

Automatically assesses risk built on advanced modeling with machine learning.

Customized solutions

Flexible strategies based on your business needs.

Integrated dashboard

Tools to quickly review suspicious transactions.

Automatically recognize good, bad, and new transactions

Identity Behavior Analysis recognizes identity usage to help increase acceptance rates, lower review rates and boost your merchant’s bottom line.

Use data insights to protect your business and improve customer experiences

- Uncover risky or bogus transactions

- Apply the industry’s most advanced AI

- Make better payment decisions based on your priorities

- Gain the insights you need to understand your customers

Partner with Cybersource for business innovation and growth

Your customers’ needs. Your needs. Our payment solutions work for everyone.

Offer your customers’ integrated solutions for fraud, tokenization and more. Our platform is flexible: integrate once and get the flexibility to create and evolve payment solutions for you and your merchants.

Related products

3-D Secure

Authenticate customers, shift liability for fraudulent transactions, and support compliance.

Account Takeover Protection

Protect online accounts from unauthorized access by fraudsters.

Tokenize your customers’ payment credentials

Keep payment data off your system and streamline token management.

Payer Authentication for 3-D Secure

Payer Authentication allows you to take full advantage of all the latest authentication capabilities available through 3-D Secure.

Build on what you have

Find solutions that complement and build upon your existing technologies.

Choose the brand strategy that's right for you

Leverage the Cybersource brand or use your own brand to provide a seamless experience for your customers.

Balance innovation and security

Incorporate fraud and data protection solutions that help you and your customers grow without sacrificing security.