Decision Manager’s machine learning capabilities combine automated strategy suggestions with a “what if” testing environment. You can optimize your fraud strategy, then roll it out once you’ve defined the best approach for your business.

Automated suggestion engine

Rules Suggestion Engine applies Decision Manager's advanced machine learning models to your historical transaction data to spot unique patterns and recommend new strategies.

Decision Manager Replay

With Decision Manager Replay, you can test the effect of fraud strategies against your historical transaction data in minutes with a "what if" analysis—helping you gauge how things would play out in the real world.

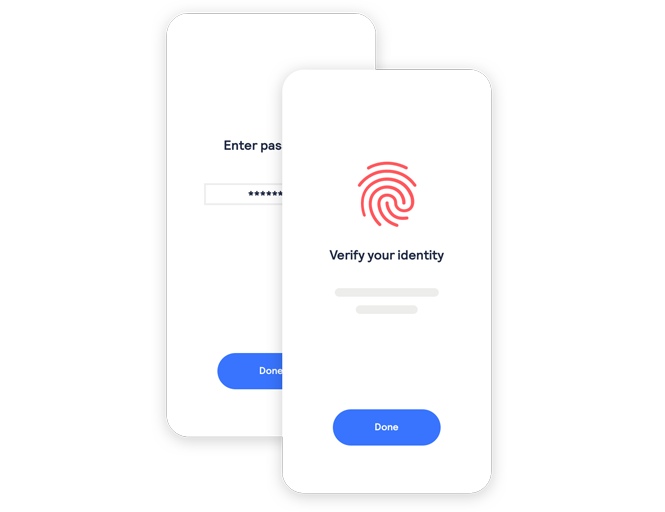

Our Identity Behavior Analysis feature recognizes identity usage behaviors to help increase your accept rates, lower your review rates, and boost your bottom line.

Decision Manager pre-authorization

With Decision Manager, you can run rules before authorization to help reduce costs, capture revenue, and over time, help improve authorization rates by filtering out risky transactions.

Five reasons to use pre-authorization:

- Save on authorization fees: Pre-authorization rejection can determine if the transaction is fraudulent and reject it, so you can avoid issuer authorization fees.

- Improve customer satisfaction: Avoid placing an unnecessary hold on a customer’s payment card.

- Control authentication: You decide whether Payer Authentication is needed to continue to the authorization.

- PSD2 SCA exemptions: Check if exemptions are applicable and set business rules accordingly.

- Increase authorization rates: The pre-authorization process will run machine learning models and merchant rules to help instill a higher degree of confidence in issuers and help lead to increased authorization rates.

Experience and big data can get it done

Decision Manager is a Visa-owned fraud solution, fully integrated with all of its systems, data and analytics—plus 20+ years of experience and insights:

269B

Transactions

Insights from more than 269 billion VisaNet transactions.1

99.9%

Uptime

The global reach and advanced capabilities of the Visa ecosystem, with an uptime of 99.999%.2

600ms

Average screening time

Average transaction screening times of less than 600ms.1

3.2B

Screened transactions

Screened by Decision Manager in 2023.3

Use data insights to protect your business and improve customer experiences

- Uncover risky or bogus transactions

- Apply the industry's most advanced AI

- Make better payment decisions based on your priorities

- Gain the insights you need to understand your customers

Get bigger insights with Decision Manager

Decision Manager provides the flexibility, precision, insights and expertise you need to find the perfect balance—combined with the confidence that comes from partnering with a trusted global leader with a proven track record of success.

More good payments = more revenue

False positives weaken customer loyalty and hurt your business. Decision Manager keeps fraud low, satisfaction high, and revenue flowing as your business grows and evolves.

Deep expertise + data-driven insights = more good payments and fewer fraudulent transactions.

Data-rich machine learning

Automatically assesses risk built on advanced modeling with machine learning.

Customized solutions

Flexible strategies based on your business needs.

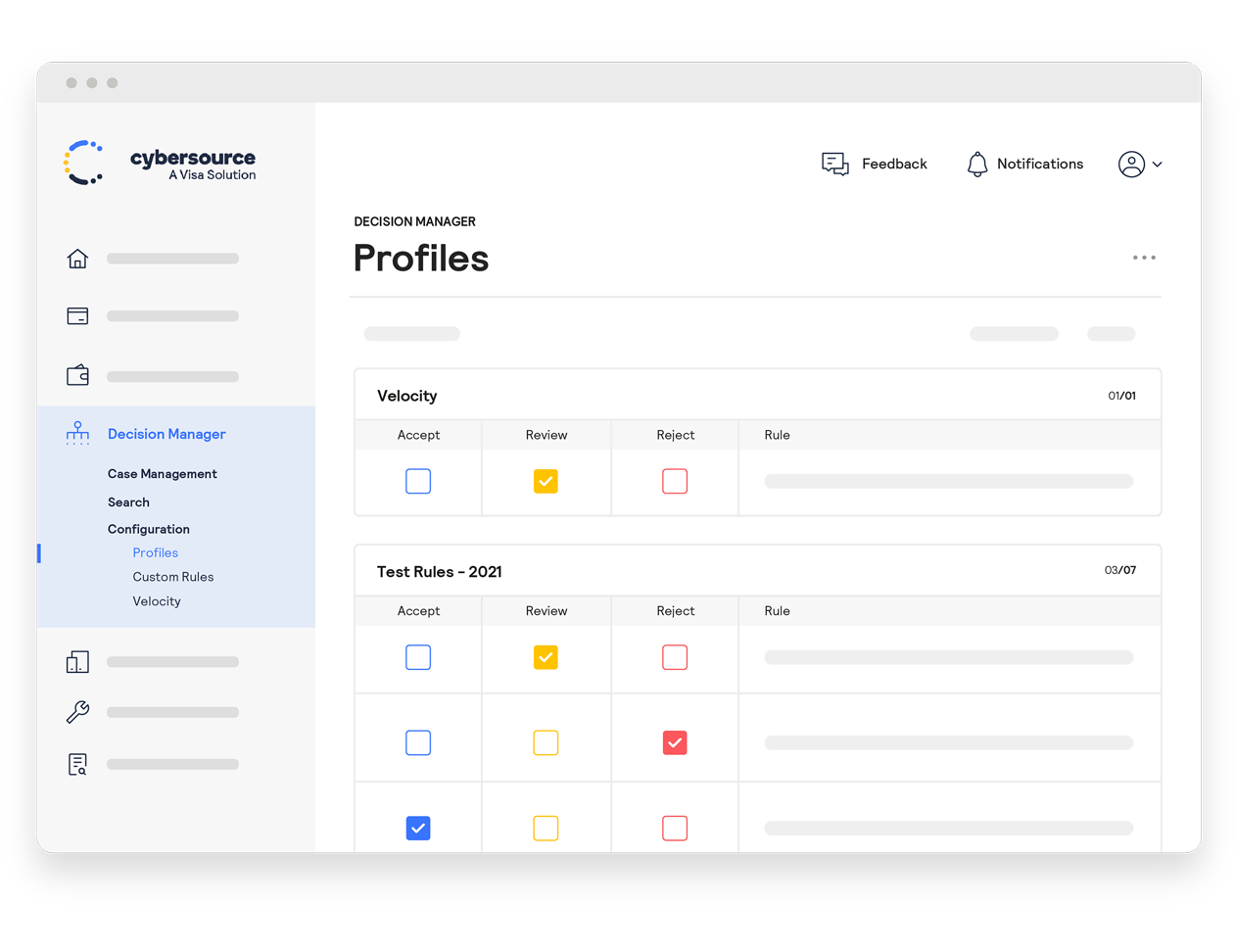

Integrated dashboard

Tools to quickly review suspicious transactions.

Managed Risk Services

Managing payment risk can be a complex balancing act for eCommerce business. But you don’t have to do it alone. Expand and enhance your in-house fraud capabilities by adding experienced analysts who can step in to provide the extra knowledge to lower your payment risks.

Consult our fraud management experts

Complement your in-house skills and resources with our Managed Risk Services team. Our global analysts can help you design, implement, and maintain a fraud strategy that’s customized for your business. Available in five continents, with decades of experience.

Outsource your manual review

Get expert help increasing your acceptance rates, fulfilling shipments, and mitigating fraud with our Managed Risk Services team. Completely outsource your review process to our team, or augment your team's efforts with overflow, after-hours and peak season support available 24/7, 365 days a year.

Fraud strategy innovation white paper

Learn how advanced fraud strategies are opening the door to secure innovation, payment fraud management, and expansion for today’s eCommerce businesses.

Working with issuers to improve authorization rates

Learn how we can help your business increase issuer authorization rates, improve customer satisfaction, and recover lost revenue.

eCommerce fraud management trends

Discover why eCommerce fraud is so prevalent, the nine types of eCommerce fraud, and most importantly, fraud management trends to help you stay ahead of evolving fraud attacks.

Related products

3-D Secure

Authenticate customers, shift liability for fraudulent transactions, and support compliance.

Account Takeover Protection

Protect online accounts from unauthorized access by fraudsters.

Tokenize your customers’ payment credentials

Keep payment data off your system and streamline token management.

Payer Authentication for 3-D Secure

Payer Authentication allows you to take full advantage of all the latest authentication capabilities available through 3-D Secure.

Fraud management designed for crypto

Learn how our crypto fraud management solution guide can meet your fraud needs by maximizing acceptance with proven risk management strategies.

Get ready for peak shopping season

Here are five tips to help prepare your business for peak shopping season.

How fraudsters adapt to eCommerce trends

Fraudsters adapt to take advantage of changes in the eCommerce environment. Here we outline four key aspects of fraud evolution that businesses should look out for.

1 VisaNet transaction volume based on 2023 fiscal year. Domestically routed transactions may not hit VisaNet.

2 Data is measured and validated from internal instance of Tableau Server based on payment volume from the Cybersource and Authorize.net Product Fact data source. Provided by payment processing product team. Data is measured and validated from internal instance of Tableau Server based on billable transactions from the Cybersource and Authorize.net Transaction Fact data sources.

3 Represents the number of payments processed through Decision Manager in the 2023 fiscal year.

Already a Cybersource customer?

Make a good thing even better by adding Decision Manager to your Cybersource payment platform.